US stocks rose to record levels in Wednesday trading before giving way after the Federal Reserve indicated there may not be a December interest rate cut. Meanwhile, for international stock funds, one of my new “Buys” this week is the Matthews Pacific Tiger Fund Investor (MAPTX), observes Brian Kelly, editor of MoneyLetter.

The benchmark S&P 500 Index (^SPX) finished the day flat. The tech-heavy Nasdaq Composite was the lone winner, gaining 0.6%. The Dow Jones Industrial Average declined 74 points (0.2%).

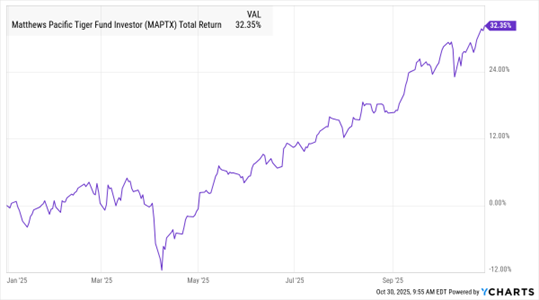

MAPTX (YTD % Change)

Data by YCharts

Despite the turnaround in Wednesday’s session, stocks have been quite strong lately. Several factors are propelling the markets. In addition to an accommodative Fed, deals among companies involved in Artificial Intelligence (AI) and optimism over foreign trade deals have been supportive. President Trump met with Chinese President Xi yesterday in South Korea.

Our global stock markets were all higher for the reporting period. From Oct. 22 through Oct. 29, the S&P 500 was up 2.9%, the Euro Stoxx 50 moved ahead by 1.2%, the Nikkei 225 continued its strong run, gaining 4.1%, and the Shanghai Composite was up 2.6%.

As for MAPTX, the fund seeks to achieve its investment objective by investing at least 80% of its net assets, which include borrowings for investment purposes, in the common and preferred stocks of companies located in Asia ex-Japan. That consists of all countries and markets in Asia excluding Japan, but including all other developed, emerging, and frontier countries and markets in the region.

Recommended Action: Buy MAPTX.