Pfizer Inc. (PFE) finally topped Novo Nordisk (NVO) to buy Metsera after Novo raised its bid twice. Metsera’s crown jewel is MET-097i, a weekly and monthly injectable GLP-1 asset that’s about to begin Phase III development, writes John McCamant, editor of Medical Technology Stock Letter.

Pfizer ended up paying $10 billion, a significant uptick from the $5 billion value of the companies’ original buyout deal, inked in September. Pfizer agreed to pay $65.60 per share upfront for Metsera, while also committing to pay up to $20.65 per share via a contingent value right (CVR). The CVR is tied to the achievement of three specified clinical and regulatory milestones, with PFE not providing specifics on the exact goals.

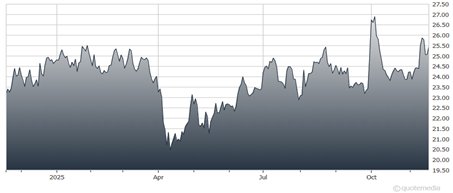

Pfizer Inc. (PFE)

Other pipeline prizes include MET-233i, a monthly amylin analog candidate in phase 1 development alone and in combination with MET-097i, and an oral GLP-1 candidate also in Phase I. In our view, Viking Therapeutics Inc. (VKTX) is the next likely target for Novo and any of the other bidders who missed out on Metsera.

In addition to a next-gen GLP-1, VK2735, which is in dual development for both oral and subQ, VKTX also has a very interesting amylin drug in development.

As for the biotech sector overall, the State Street SPDR S&P Biotech ETF (XBI) closed at a new high again recently after Merck & Co. (MRK) announced it was buying Cidara Therapetutics Inc. (CDTX) for almost $10 billion – a premium of more than 100%. The biotech M&A wave continues and Merck was a prime acquirer with the upcoming Keytruda patent expiration (2028).