In the waning few weeks of 2025, it seems markets are looking further ahead to the new year, rather than back at the slow-moving start of what many hoped would be a December Santa rally. Meanwhile, America’s old car-making giant Ford Motor Co. (F) said it was moving away from trying to sell EVs, notes Tom Bruni, editor-in-chief of The Daily Rip by Stocktwits.

Ford will turn its electric truck and car infrastructure toward battery and hybrid car sales in a major facelift. The kicker: it’s going to cost just shy of $20 billion in the fourth quarter.

The company pulled in $50 billion in sales in the most recent quarter, and $2 billion in profit. That means this coming quarter will need some advanced accounting acrobatics to reach per-share GAAP profitability at this rate.

(Editor’s Note: Tom will be speaking at the 2026 MoneyShow/TradersEXPO Las Vegas, scheduled for Feb. 23-25. Click HERE to register.)

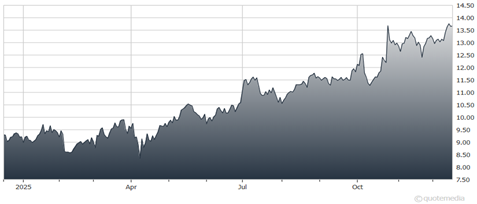

Ford Motor Co. (F)

But the hefty price tag was actually not a bad look, with the stock climbing a bit because investors were looking for almost any encouraging news following years of EV losses. The division lost $13 billion in the past two years, and CEO Jim Farley said they are pivoting.

“This announcement is about moving to more profitable vehicles,” Farley said. Ford is cutting certain EVs like F150 trucks and moving toward a product lineup that includes a $30,000 EV pickup, but also measures half of sales volume in hybrid vehicles.

Ford is turning its Kentucky EV battery factory into an energy storage business for wind, solar, and even data center developers. In short, Ford is testing the age-old art of war saying: “If no one wants to buy your batteries on wheels, cement them into the ground.”