This week’s macroeconomic updates were a mixed bag. But if we see continued consumer strength and a labor market that steadies itself in 2026, it could be another strong year for US stocks, advises Bret Kenwell, US investment analyst at eToro.

Headline labor figures for November topped expectations, but October’s sharp decline (-105K) underwhelmed investors and pointed to a cooling labor market. The unemployment rate, which has been steadily rising from 4.1% in June, jumped to 4.6% — the highest reading since September 2021.

That said, October’s retail sales data reinforced a central theme for investors and the Federal Reserve: The resilience of US consumers. Core retail sales topped expectations and “control group” sales — the most stringent cut of data within the report that are used to calculate GDP — came in well ahead of estimates. It also hit its highest level since the summer.

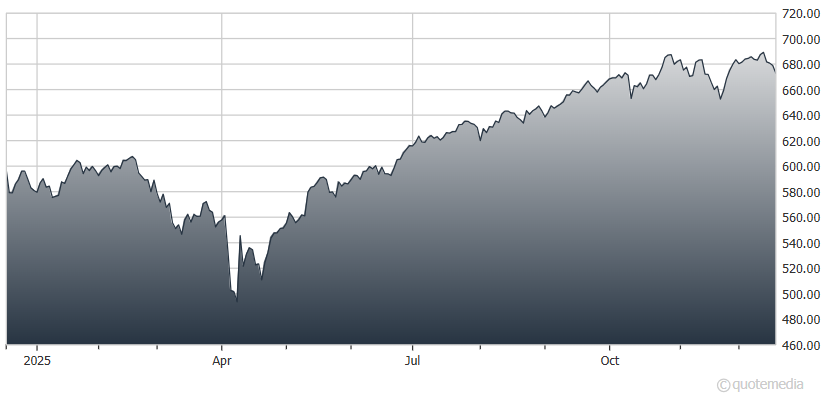

SPDR S&P 500 ETF (SPY)

With the continued cooling in the labor market, the Fed should still lean slightly more dovish as attention turns to 2026. Investors should not cheer for a notable deterioration in the jobs market, though, because it would have a direct impact on the economy and on corporate earnings.

It’s worth noting that a majority of US retail investors (63%) expect the bull market to continue in 2026. Recent rate cuts have prompted 53% of retail investors to adjust their portfolios, and of those planning further changes, 30% intend to invest more — with a focus on growth stocks (25%), cash (23%), and dividend stocks (19%).