With the November Consumer Price Index (CPI), only some of the month was captured because information didn’t start being calculated until Nov. 14. Still, it rose 2.7% year-over-year on the headline and 2.6% ex-food and energy, better than the estimates of up 3.1% and up 3%, respectively, advises Peter Boockvar, editor of The Boock Report.

Energy prices were up 4.2% YOY because of an 11.3% jump in fuel oil. Food prices were up 2.6% YOY, mostly led by “food away from home,” where prices were up 3.7% vs. 1.9% for “food at home.” Services inflation ex-energy rose 3% YOY vs. 3.5% in September and with Owners’ Equivalent Rent up by 3.4%

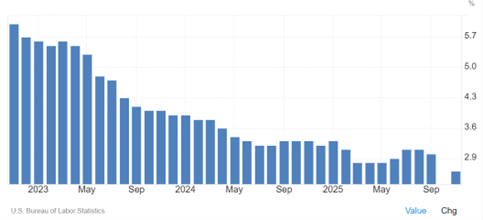

Core CPI (YOY % Change)

Source: Trading Economics

Rent of Primary Residence was up 3% vs. 3.4% in September. Tenant and household insurance prices spiked by 7% YOY. Medical care costs were up by 3.3% YOY, with a 5.7% jump in medical services. Not reality was the 0.6% YOY rise in health insurance prices. I’ll take that plan.

On the core goods side, they rose 1.4% YOY vs. 1.5% in September. Used car prices rose 3.6% YOY, while new car prices gained 0.6%. Apparel prices rose 0.2% YOY after a one-tenth drop in September. Prices of household furnishings and supplies gained 2.6% YOY.

Bottom line: the deceleration of rental growth helped to moderate services inflation and is the main reason for the inflation miss. Medical care costs also slipped. What inflation would have been if the full data was collected will remain to be seen.

I’m also not sure why auto insurance was not included in the YOY figure as that has been a hot spot of price gains as we know. Other prices were missing, too. I expect further rental price growth into the first half of 2026. Then it should move higher in the latter part of next year and into 2027 because of the lack of new construction.