The year 2025 has been a tough one for oil prices. North American benchmark crude began 2025 in the low $70s. Now with just a couple weeks to go in the year, it’s struggling along in the high $50s with bearish sentiment thick. But I still like Chevron Corp. (CVX) below $160, writes Elliott Gue, editor of Energy and Income Advisor.

Meanwhile, it has been a good year for natural gas. And thanks to that, Energy and Income Advisor stocks have on the whole continued to build wealth.

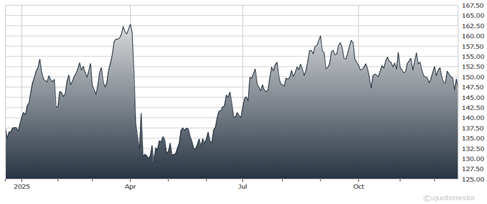

Chevron Corp. (CVX)

Chevron’s biggest move recently was closing the acquisition of Hess Corp. to become a 30% owner of Stabroek, the prolific oil and gas field off the coast of Guyana. That sets the company’s production profile up nicely the next few years, along with natural gas development in the eastern Mediterranean Sea and oil and gas in the Permian Basin.

Chevron’s year-to-date total return is about 8%, with the dividend raised 4.9%. We expect a similar payout boost next month but a larger total return on higher commodity prices, rising output, and relentless cost cutting.