The market started yesterday off on a sour note...again. But then key tech stocks turned on the jets, with Nvidia (NVDA) soaring more than 8%. Other Big Tech names like Tesla (TSLA) got in on the act, too.

Today, stocks are mixed, while gold, silver, Treasuries, and the dollar are flat. Crude oil is pulling back.

On the news front...

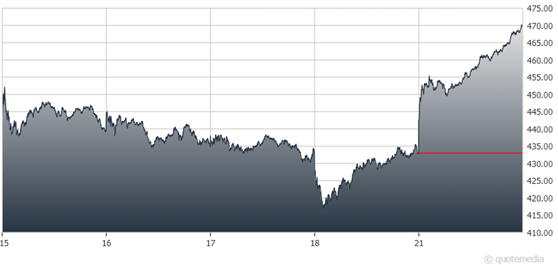

It’s hard to say what triggered the tech tornado to blow through the market. Nvidia reports earnings on Wednesday and it could’ve been some investors jumping the gun. But clearly, this was a big move as you can see in this five-day chart.

Nvidia (NVDA)

After surging for several days, interest rates also took a breather – something that takes some pressure off tech stock valuations. SoftBank Group (SFTBF) also filed for the Arm Ltd. mega-IPO I wrote about yesterday, and Chinese currency and stock selling finally tailed off.

Of course, markets are also looking ahead to this week’s Federal Reserve Symposium in Jackson Hole, Wyoming. It kicks off Thursday and lasts through Saturday, with Fed Chairman Jay Powell set to speak on the economy and Fed policy Friday morning just after 10 a.m. Eastern.

Investors are wrestling with the question of just how aggressive Powell will be in order to get inflation closer to 2% from around 3% now. The Wall Street Journal’s “Fed Whisperer” reporter Nick Timiraos wrote about the debate today, and any hints Powell gives on Friday about which way the Fed is leaning will undoubtedly have significant market impacts.

Finally, there has been a lot of chatter lately about how consumers are falling behind on car loan payments even with relatively low unemployment. A key problem? They’re biting off more car loan than they can chew because cheap cars are a thing of the past!

There is only ONE new car model with an average sales price of less than $20,000 now – the bare-bones version of the Mitsubishi Mirage. The average new vehicle sells for more than $48,000, according to Cox Automotive data. That’s up 25% since right before the pandemic.