Stocks finally showed signs of life yesterday, with a big late-day ramp to the upside. We’re looking at a solid start today, too. Gold and silver are mixed, while Treasuries, crude oil, and the dollar are mostly flat.

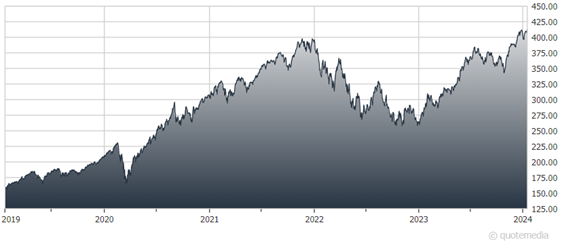

Just when “stock market crash” started trending on Twitter/X (No really. It did earlier this week when the S&P 500 was down just 0.6% year-to-date.), markets found their footing. Not only that, but the Nasdaq 100 and its tracking ETF the Invesco QQQ Trust (QQQ) managed to set record highs, powered in part by strength in semiconductors and “Magnificent Seven” names in tech.

Invesco QQQ Trust (QQQ)

One thing helping markets is the ongoing “okay-ness” of the economic data. Jobless claims just fell to the lowest level since September 2022, while housing starts and permits topped expectations. That helped offset another round of disappointing manufacturing data. It all adds up to a “soft landing” scenario rather than a slump into recession, which many investors were concerned about a year ago amid aggressive Federal Reserve rate hikes.

Finally, we’re seeing ongoing turmoil in the airline sector this week. Shares of Spirit Airlines (SAVE) plunged a few days ago after a federal judge backed the Justice Department’s case against a merger with JetBlue Airways (JBLU). But they rallied this morning after the discount airline said it would take steps to boost liquidity and try to proceed with the deal anyway.