Stocks were mixed on Friday, with the Dow selling off but the Nasdaq slightly higher. We’re seeing a bit more pressure in equities so far this morning, while gold, silver, and crude oil are all up. Treasuries are flat.

The Big Tech lawsuits and investigations keep piling up, with the European Commission now probing corporate behavior at Apple Inc. (AAPL), Alphabet Inc. (GOOGL), and Meta Platforms Inc. (META). The latest investigations cover app store rules, search practices, and subscription fees, among other things. They follow the enactment of a new European Union law called the Digital Markets Act which is designed to rein in technology company practices.

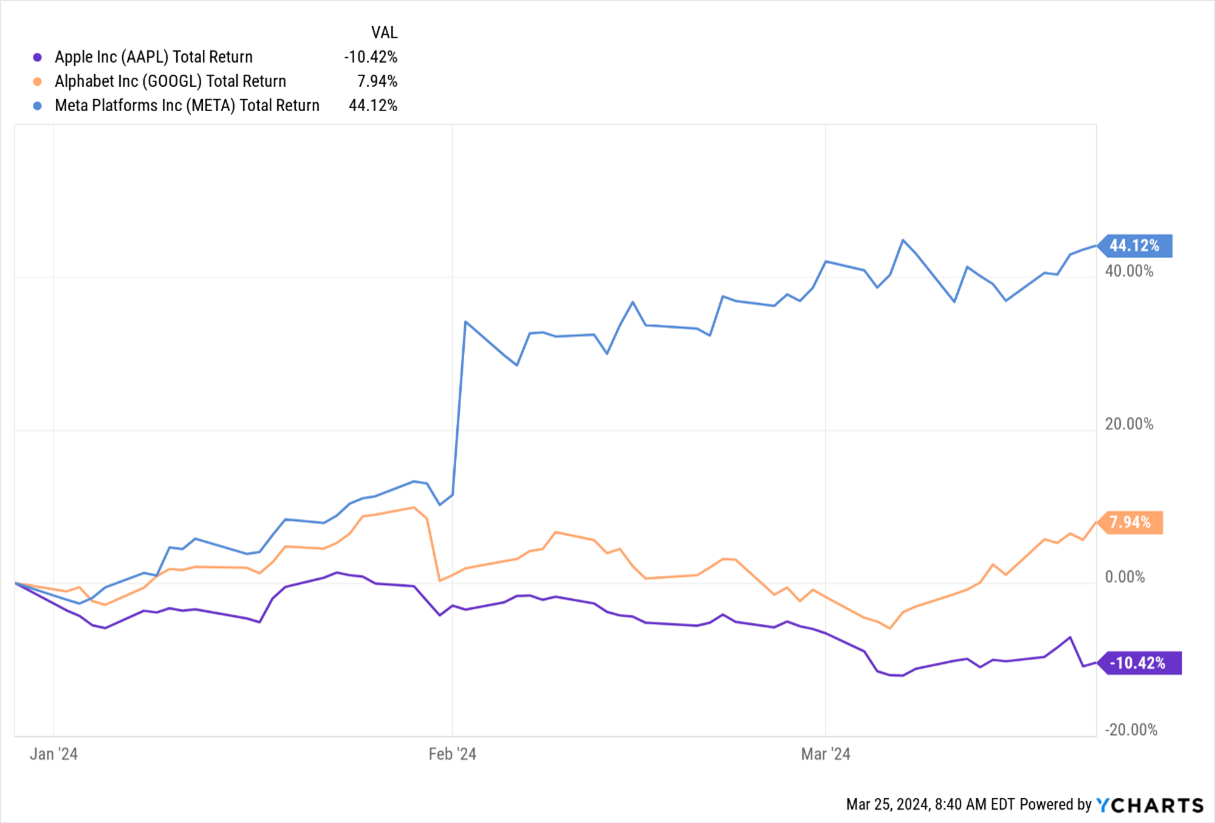

META is still doing very well on the year, up around 44% through last Friday. But GOOGL is now lagging the S&P 500 slightly, while AAPL is down more than 10%.

Data by YCharts

Funds that sell options to generate premium income are a red-hot investment these days, with assets in that fund category topping $67 billion last month. Morningstar Direct tracked only $7 billion in those funds at year-end 2020. The JP Morgan Equity Premium Income ETF (JEPI) is the most popular, with just under $33 billion in assets. It has gained 6% year-to-date and features a dividend yield of around 8%.

Investors like these funds because they offer higher yields, but some experts worry their popularity is suppressing volatility in the markets. That, in turn, could set the stage for a volatility explosion like we saw in February 2018. The so-called “Volmageddon” crisis caused widespread losses and led two volatility-related funds to close.

Finally, The Boeing Co. (BA) announced its embattled CEO Dave Calhoun will step down at the end of 2024. Board Chairman Larry Kellner will also give up his seat, while the firm’s commercial airplanes division head will retire. The airplane manufacturer faces intense government, customer, and investor scrutiny after a series of missteps and alleged product failures.