Following Friday’s post-jobs data selloff, markets are mostly marking time this morning. Stocks, gold, and silver are flat, while crude oil is a bit higher along with the dollar. Treasuries are modestly weaker.

No matter what you think about this market, you can’t say it’ll be a dull week! That’s because Wednesday will bring about the release of both the May Consumer Price Index AND the conclusion of the latest Federal Reserve policy meeting. The Fed won’t raise or lower rates at this meeting, but Chair Jay Powell will have the chance to signal to markets what he thinks he’ll do later this year.

Naturally, a big driver of policy will be inflation – so the CPI data matters a lot. Economists expect a 0.2% rise on the headline CPI and a 0.3% increase for the core. We’ll also get wholesale inflation data on Thursday and a key consumer confidence reading on Friday.

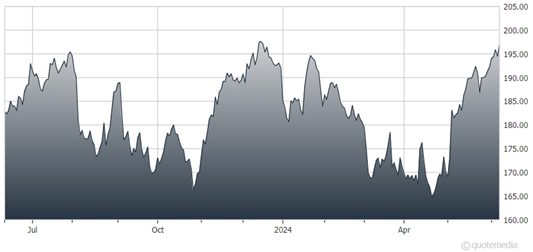

Apple Inc. (AAPL)

This is Apple Inc.’s (AAPL) week to shine...not to mention prove it can grab some of the Artificial Intelligence (AI)-driven momentum many of its tech sector rivals already have. The company is hosting its Worldwide Developers Conference this week.

Investors and analysts will be watching eagerly to see what kind of AI features will soon be added to its iPhone and computer products – and whether they’ll get Apple some mojo back. AAPL shares have risen only modestly over the past year, while shares of rivals like Microsoft Corp. (MSFT) and Meta Platforms Inc. (META) have risen much further.