Is “good news” on the economy actually “good news” for stocks? It sure looks like it so far, with stocks rallying after strong jobs data. Treasuries and gold don’t like the news, though, while the dollar did.

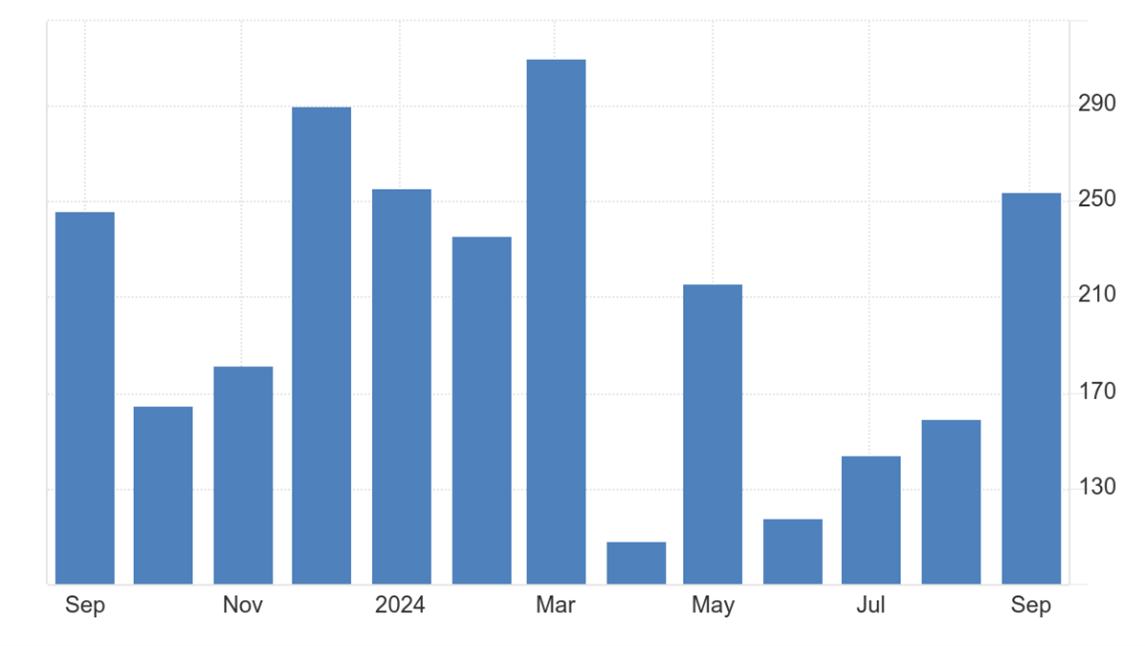

Everyone was waiting on pins and needles for this morning’s nonfarm payrolls data...and boy did it blow the doors off! The economy created 254,000 jobs in September, far higher than the average forecast of 140,000. The unemployment rate dipped to 4.1% rather than hold steady at 4.2%. Average hourly earnings rose 0.4%, a tad hotter than the 0.3% rise most expected.

Following other somewhat better-than-expected reports on the economy, the data caused traders to de-price more aggressive interest rate cuts from the Federal Reserve. And yet, that didn’t derail equities, which tend to like cheaper money. Interesting to say the least. Markets seem to be happy this is "soft landing"-type news versus the kind that suggests "We're heading into recession."

Nonfarm Payrolls (Monthly Change)

Source: Trading Economics

Dockworkers’ strike, we hardly knew ya! The International Longshoremen’s Association called off its three-day walkout after reaching a contract negotiation deal yesterday. The US Maritime Alliance reportedly offered a 62% wage increase spread out over six years, up from a previous 50% offer. Workers are returning to their jobs while the parties try to hammer out a final contract by Jan. 15, 2025.

Things haven’t been going well for Spirit Airlines Inc. (SAVE) for some time, with the stock down a whopping 88% year-to-date. Now, SAVE shares are plummeting further on reports it may file for bankruptcy. Spirit has lost money in five of the last six quarters, and it has just over $3 billion in debt. Plus, the Department of Justice previously sued to block its proposed $3.8 billion merger with JetBlue Airways Corp. (JBLU), and the companies called it off after a federal judge sided with the DOJ.