The markets were on pins and needles headed into today’s key inflation report – and the reaction after it came out was immediate. Stocks plunged, Treasuries tanked, the dollar rose, and gold, silver, and crude oil slid.

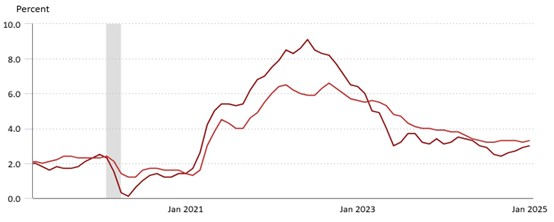

What was so bad about the data? The Consumer Price Index rose 0.5% overall in January when markets were expecting a 0.3% gain. The core CPI rose 0.4%, more than the 0.3% that was expected. On a year-over-year basis, prices are now up 3% (headline) and 3.3% (core), both of which represent accelerations from December.

CPI Hits 3% Again, Fueling Market Swoon

Source: Bureau of Labor Statistics

In testimony before the Senate Banking Committee yesterday, Chairman Jay Powell indicated that the Fed would sit on its hands for a while when it comes to interest rates. Specifically, he called the current federal funds rate level “significantly less restrictive” than it once was and said “we do not need to be in a hurry to adjust our policy stance.”

The CPI data basically cements that “going nowhere” policy for a while. Currently, the Fed’s rate target is 4.25% to 4.5%. Meanwhile, President Trump’s Treasury Secretary Scott Bessent has suggested the administration is more focused on keeping long-term yields, like those on the 10-year Treasury, down rather than worrying as much about the short-term funds rate. But more data like this will make that a tough goal to accomplish.

Finally, former tech sector high-flyer Super Micro Computer Inc. (SMCI) is rising in early trading. The company makes computer servers that utilize Nvidia Corp. (NVDA) chips, and it rode NVDA’s coattails to big gains a year ago. But after a short-selling firm alleged accounting irregularities, SMCI shares plunged and the firm said it might be delisted from the Nasdaq for not being current on its regulatory filings. The rally today stems from news it should meet a Feb. 25 filing deadline.