Stocks are giving back some ground this morning after a strong finish yesterday. Gold, silver, and oil are also retreating, while Treasuries and the dollar are flatlining. Bitcoin is back to trading around $105,000 after early-week strength.

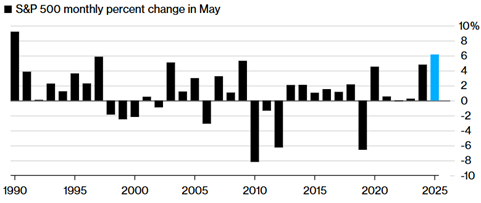

In the end, May has proven to be a blockbuster month for stocks. Barring any unforeseen collapse today, the S&P 500 will finish with a gain of more than 6% for the month. That would make this the best May showing for the index since 1990.

Source: Bloomberg

On the flip side, a broad Treasury index is suffering its first down month in 2025 – with long-term bonds getting hit particularly hard. Storm clouds may also loom for stocks in June. After all, everyone on Wall Street and in Washington is wondering “What happens next with tariffs and trade?” given the whirlwind of developments in the last 24 hours.

First, the US Court of International Trade ruled against President Trump and his use of the International Emergency Economic Powers Act of 1977 to implement several of his tariffs. Then, a federal court temporarily postponed the implementation of that court’s ruling to give attorneys on both sides time to prepare and present appeals arguments.

In case its appeal to that court – and the Supreme Court later, if necessary – fail, the administration is reportedly weighing other options. It could fall back on the Trade Act of 1974 or even the Smoot-Hawley Tariff Act of 1930 as the legal basis for a renewed tariff push. Meanwhile, Treasury Secretary Scott Bessent weighed in on US-China talks yesterday, saying they were “a bit stalled” and suggesting a Trump conversation with Chinese president Xi Jinping may be needed to move things along.

Finally, we got another mixed bag of earnings reports from the retail sector. Costco Wholesale Corp. (COST) continued to shine, with earnings per share of $4.28 beating analyst forecasts and same-store sales climbing 8%. But clothing retailer Gap Inc. (GAP) warned that tariff policy would boost costs by as much as $150 million in the current fiscal year. It also said sales would flatline this quarter. COST shares were little changed recently, while GAP shares are tanking.