Equities are taking a breather after a fantastic second quarter. Crude oil, gold, and silver are rallying, though. Treasuries are flattish, while the dollar is dipping.

The stock market just notched its best quarter since 2023, and the S&P 500 just closed at a record high for two trading days in a row. But will the strength continue in Q3? Probably at least through July, according to Goldman Sachs Group Inc. (GS).

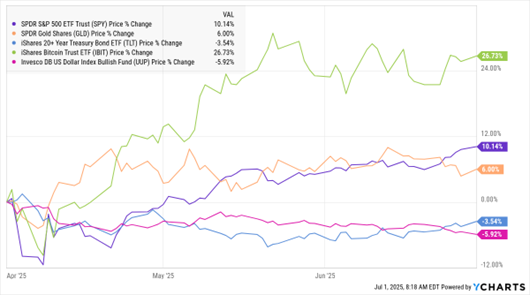

The firm noted that the S&P hasn’t dropped in any July since 2014. Plus, the index's average historical return for the month since 1928 is 1.67%. As for Q2, the SPDR S&P 500 ETF Trust (SPY) gained 10.1%, while the SPDR Gold Shares (GLD) rose 6% and the iShares Bitcoin Trust ETF (IBIT) surged 26.7%. ETFs that track long-term Treasuries and the dollar fell 3.5% and 5.9%, respectively.

SPY, GLD, TLT, IBIT, UUP (Q2 % Change)

Data by YCharts

Wall Street is continuing to eye the “Big Beautiful Bill” drama in Washington. President Trump wants a bill on his desk to sign by the Fourth of July. But disagreements about its budget-busting price tag, energy-related provisions, and other issues are holding things up. Tesla Inc. (TSLA) shares are also slipping amid a renewed feud between CEO Elon Musk and Trump over a bill provision that would tax green energy companies (and cost TSLA money).

Finally, the robot revolution is a very real thing at Amazon.com Inc. (AMZN). More than 1 million robots are now sorting, packing, and moving boxes and products around its warehouses – almost equal to the firm’s human workforce in those facilities. Each AMZN facility now averages 670 human workers, the lowest in 16 years. But Amazon officials say that many human workers are now training for and taking higher-paying jobs, even as menial and body-taxing tasks are being automated.