After yesterday’s rotational action – with Big Tech sliding and small caps rallying – stocks are fairly quiet in the early going today. Crude oil is rising, while gold and silver are mixed. The dollar is modestly higher along with interest rates at the long end of the curve.

The end of President Trump’s 90-day tariff “pause” period is fast approaching. But negotiating progress has been hard to come by with many nations, including Japan. Trump lashed out at Tokyo overnight, threatening to raise the current 25% tariff on Japanese cars to 30% or 35%. Markets have been able to rally for several weeks now despite tariff uncertainty, in part because the president and many of his surrogates have suggested the July 9 deadline isn’t REALLY a deadline.

In other news from Washington, the “One Big Beautiful Bill” slipped through the Senate yesterday. But some House Republicans are balking at its overall cost and certain provisions. Investors will continue to watch the negotiating process there. Trump has said he wants a bill on his desk to sign by July 4.

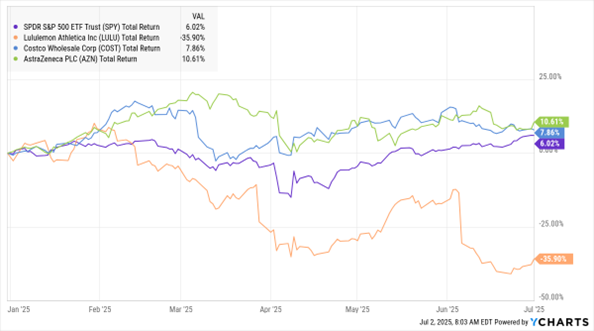

SPY, LULU, COST, AZN (YTD % Change)

Data by YCharts

Meanwhile, a war over athletic wear is breaking out. Lululemon Athletica Inc. (LULU) is suing Costco Wholesale Corp. (COST), alleging the warehouse club retailer is selling knockoff versions of LULU’s high-end workout and athleisure clothing. The fight over products like ABC pants, Define jackets, and Scuba hoodies is just the latest chapter in a long-running battle over cheap “dupes” of popular fashion items. COST declined to comment.

Finally, Initial Public Offerings (IPO) and public listings are drying up...in the UK. Not only are more companies staying or going private there – just like in the US – but more already-public companies are shifting their primary listings to the US. The CEO of AstraZeneca PLC (AZN), Pascal Soriot, just said he wants to shift his firm’s listing to New York from London. It’s the most-valuable company traded in the UK, with a market capitalization of 161 billion British pounds.