Investors are cautiously bidding up equities in the early going amid a flood of M&A and earnings-related news. Crude oil, gold, and silver are mostly flat, while the dollar and Treasuries are rallying.

Now, let’s talk about the mega-deal in the transportation sector. Union Pacific Corp. (UNP) is buying Norfolk Southern Corp. (NSC) for $85 billion, the biggest railroad deal on record. UNP has a sizable presence in the western US, while NSC has significant operations in the eastern part of the country. They will now control more than 50,000 miles of railroad track.

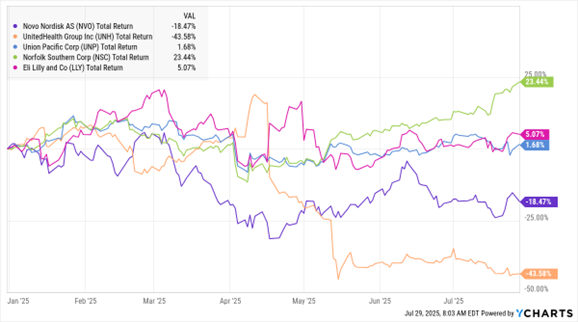

UNP, NSC, NVO, LLY, UNH (YTD % Change)

Data by YCharts

Neither stock moved much on the news because reports have been circulating for several days that a deal was imminent. Regulators will scrutinize the deal given the market dominance the combined firm will have. But investors expect approval will be easier to get in the Trump Administration than it would’ve been with Biden in office.

Novo Nordisk AS (NVO) warned that sales and earnings growth would miss targets, sending its shares sharply lower. In the obesity drug battle, the Wegovy and Ozempic maker is struggling to compete with Eli Lilly & Co. (LLY). NVO was already down 18.4% year-to-date before today, while LLY was up 5%.

Meanwhile, challenges continue to mount at the health insurance giant UnitedHealth Group Inc. (UNH). Already facing higher-than-expected medical expenses, the firm warned adjusted profit would now come in around $16 per share in 2025. Analysts expected $20.40. Government programs like Medicaid, Medicare, and the Affordable Care Act markets are changing, putting pressure on industry profits. UNH shares were down 43.5% YTD as of yesterday.