After another solid move higher yesterday, stocks are marking time this morning. Ditto for Treasuries. Gold, silver, and crude oil are modestly higher, while the Dollar Index is testing the 97 level again – and closing in on a fresh 2025 low.

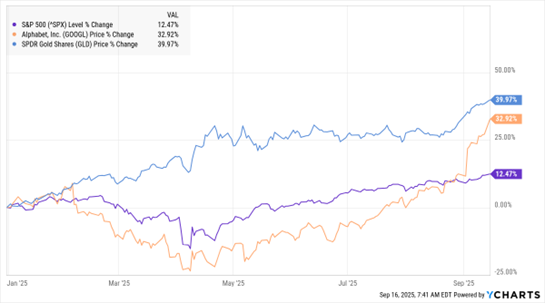

Overall, stocks have been powering higher as the “Run it hot” trade gains steam. The S&P 500 Index (^SPX) just hit another record high, while the Nasdaq Composite extended its win streak to nine sessions. Alphabet Inc. (GOOGL) also topped $3 trillion in market capitalization. Driving the action: Wall Street expectations of cheaper money, plus an economic resurgence fueled by tax cuts and less government regulation.

SPX, GOOGL, GLD (YTD % Change)

Data by YCharts

Speaking of cheaper money, the Federal Reserve’s two-day policy meeting begins today – and things are more interesting than usual given the personnel dynamics in play. President Trump’s attempt to force Fed Governor Lisa Cook from her position was just blocked by an appeals court, allowing her to participate in this meeting. Meanwhile, Trump's economic adviser Stephen Miran was confirmed as a Fed Governor late Monday. That means he’ll take part in the meeting as well.

The increased politicization of the Fed is one reason gold continues to rally. It hit yet another all-time high overnight of $3,737 an ounce. The precious metal is up 40% year-to-date, making this its best year since 1979. Back then, inflation was soaring thanks to the 1970s-era energy crisis.

While Initial Public Offering (IPO) activity is coming back strong, PRIVATE markets continue to attract an incredible amount of capital. Bloomberg reports that the 20 largest pension funds now hold $5 TRILLION in private assets, including private credit and private equity investments.

The promise of higher potential returns, lower volatility, and increased diversification has driven money to private assets. But some worry about "hidden" financial stability risks that can result from the movement of money to less-regulated, more-opaque markets.