After a mixed day on Friday, stocks are flattish in early trading today. Precious metals are rocketing higher again, while the US dollar is sliding. Treasuries are up a bit, while energy markets are mixed.

We finished last week with silver powering through $100 an ounce, and we’re starting this week with gold vaulting above $5,000 for the first time ever. More tariff threats from President Trump over the weekend, along with ongoing central bank buying and investors jumping on the “debasement trade” bandwagon fueled the gains.

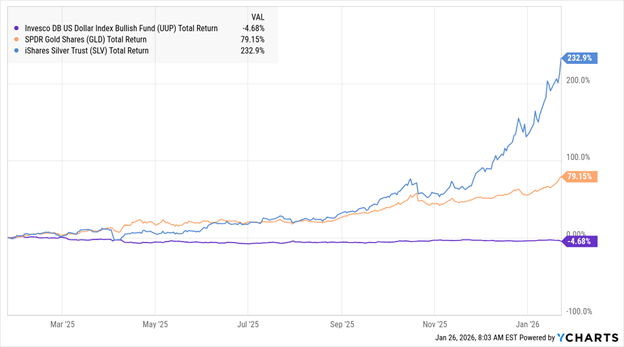

UUP, GLD, SLV (1-Year % Change)

Data by YCharts

Meanwhile, the US dollar continued to sink, hitting a four-month low. The move stemmed from a sharp rally in the Japanese yen against the dollar, one driven by expectations Japanese officials would intervened to prop their currency up. The Invesco DB US Dollar Index Bullish Fund (UUP) has slumped 4.7% in the last 12 months, while the SLDR Gold Shares (GLD) has surged 79.1% and the iShares Silver Trust (SLV) has rocketed 232.9%.

The US government is reportedly set to help finance another domestic rare earth company. USA Rare Earth Inc. (USAR) will get $1.6 billion from Uncle Sam in exchange for a 10% equity stake. The Oklahoma-based company will also receive another $1 billion in private financing to help it develop a Texas mine and a neo magnet factory. Already up 109% in the past year, USAR stock jumped another 14% on the news.

Finally, there’s a new $2.4 billion deal in the infrastructure sector to talk about. Leidos Holdings Inc. (LDOS) is buying ENTRUST Solutions Group from the private equity company Kohlberg. The move will bulk up Leidos’ engineering services business, which caters to electric and gas utilities. US electricity demand is spiking thanks to the Artificial Intelligence (AI) boom and the data centers that power it.