Equities are subdued in early trading today, but strong action in foreign markets continues to draw investor attention. Gold and silver are down a bit, while crude oil is modestly higher along with Treasuries. Bitcoin is trading back below $70,000.

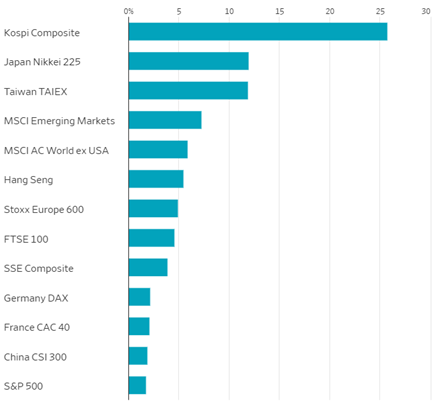

The falling US dollar, increased stimulus spending overseas, and cheaper valuations are continuing to attract a flood of funds into foreign markets. Stocks in South Korea, Japan, Taiwan, and across Europe are trouncing US equities so far in 2026, just as they did in 2025. A global MSCI index that excludes US stocks rose 29% last year, almost double the 16% rise in the S&P 500 Index (^SPX). In January alone, $51.6 billion flowed into international ETFs, according to the Wall Street Journal.

Global Markets Vs. US (YTD % Change)

Source: Wall Street Journal

Alphabet Inc. (GOOGL) is selling a bundle of bonds this week to fuel its Artificial Intelligence (AI) spending ambitions. The technology giant sold $20 billion in dollar-denominated debt Monday, and it’s following up with $9.4 billion in bonds denominated in Swiss francs and British pounds. The UK bond package will include a rare 100-year issue. Alphabet recently said it would spend a whopping $185 billion on capex this year, some of which will be funded with borrowed money.

The corporate profit parade is still ongoing, with drug store and pharmacy benefit provider CVS Health Corp. (CVS) topping earnings per share estimates by a dime in Q4. Sales also rose to $105.7 billion thanks to the addition of purchased assets from bankrupt Rite Aid. CVS stock is up 45.5% in the past 12 months.

Meanwhile, Coca-Cola Co. (KO) reported growth in unit case volume, a turnaround from recent flat-to-down quarters. The company also raised prices by 4% in North America, helping support sales. But Coke stock dipped thanks to the firm’s mildly disappointing outlook for 2026. KO shares are up 25.7% in the last year.

Finally, the iconic sportswear retailer Eddie Bauer filed for Chapter 11 bankruptcy yesterday. The 106-year-old retailer will hold liquidation sales at its 180 stores in the US and Canada. Its manufacturing, e-commerce, and global operations outside of those two countries will continue to operate while the firm seeks a buyer.