Tech stocks and precious metals are resuming their recent struggles in post-holiday trading. Crude oil is also lower, while Treasuries are flattish and the dollar is rallying.

With the Presidents Day holiday behind us, Wall Street is still struggling with what to do in the technology sector. Worries about AI disrupting a wide range of industries aren’t going away. Neither are concerns about excessive borrowing and capex spending.

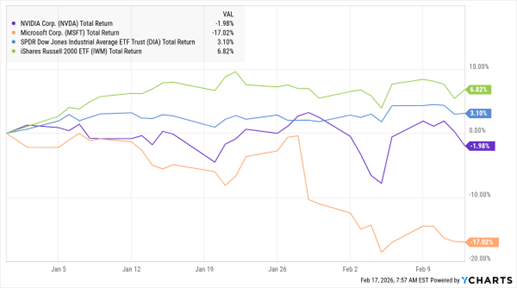

NVDA, MSFT, DIA, IWM (YTD % Change)

Data by YCharts

Worth noting: an essay about rapid improvements in AI tech and how that could eliminate a wide swath of jobs struck a nerve recently. The piece by tech investor and entrepreneur Matt Shumer called “Something Big is Happening” lit up timelines and racked up more than 80 MILLION views on X. Debate continues to rage over his methodology and assumptions, but the losses on Wall Street are very real.

Every single “Magnificent Seven” stock is down year-to-date, with losses ranging from a modest 1.9% at Nvidia Corp. (NVDA) to a hefty 17% at Microsoft Corp. (MSFT). On the flip side, the stodgier SPDR Dow Jones Industrial Average ETF (DIA) is up 3.1% so far in 2026. Plus, the iShares Russell 2000 ETF (IWM) is showing gains of 6.8%. Rotation indeed!

Finally, Elliott Investment Management is trying to help Norwegian Cruise Line Holdings Ltd. (NCLH) chart a new course. The activist investment firm built up a 10%-plus stake in NCLH shares, and it’s pressuring the fourth-largest cruise line company to improve its operations. Norwegian has struggled since even as its larger competitors have thrived – with its shares down 18.5% in the past year.