I have a confession to make. I’m not a Wall Street guy. Yes, I’m a professional money manager and have built a good business managing money for my clients using the proprietary computer algorithms I’ve built over the past 20 years. But don’t confuse me with a Wall Street guy.

I listen to some of the things that come out of Wall Street and it sounds like a bunch of gobbledygook… or worse. Here’s what I mean:

Mutual funds are you need. (Because you’re really not as smart as we are.)

Really? Yes, it’s nice to have a professional money manager, but when you need your manager the most, at market tops and market bottoms, your manager can’t manage for you! At market tops, they’re forced to buy expensive stocks because new money keeps pouring in. At market bottoms, they’re forced to sell inexpensive stocks because scared investors keep redeeming shares. When you need your manager the most, other investors are forcing your manager to act against your best interests.

Here’s another one that Wall Street loves to tell you:

Don’t try to time the market, you’ll never guess it correctly.

Turn on CNBC or read any of the financial news sites and you’ll hear this one a lot. But have you ever listened to their “esteemed” guests? All they do is pontificate and ultimately just guess what’s going to happen next. And it doesn’t matter to them. They’re not held responsible for their guesses. If they’re wrong, they just pivot and tell you why the market was wrong. But if you actually listened to these “experts” and followed their guess, er, their advice, and you lost money, well, too bad.

That’s why I don’t guess where the market is headed. Instead, I measure where the market is each week in relation to its most recent trend. I call this “Market Directional Investing”. When the market trend is bullish, I invest my clients in stocks and ETFs that are moving higher. When the market trend is bearish, I invest my clients in inverse ETFs that move higher as the market moves lower.

Wall Street doesn’t do this. Why?

Buy and hold is the best strategy. Other strategies have too much risk. They ascribe to the much ballyhooed “Efficient Portfolio Theory” that is nothing more than a cover for them to not protect you from major losses in a bear market.

Risk is the four-letter word you have to embrace if you want to beat the market. Let me translate what Wall Street is telling you. “It’s better to potentially lose half of your investments in a bear market than to try to limit your loss and even make money in a bear market.”

In the past 20 years, the markets have dropped in half twice. Will it happen again? Sure, but we don’t know when. Do you really think it’s less risky to subject your portfolio to future 50% losses? What if you could turn it around and instead of losing a lot of money in a bear market, you could actually make money in a bear market.

And what if I told you that investing in ultra ETFs, the ETFs that can move double or triple the major averages, is less risky than buy and hold?

It is less risky when you apply an intelligent system such as my Market Directional Investing methodology. Let me show you.

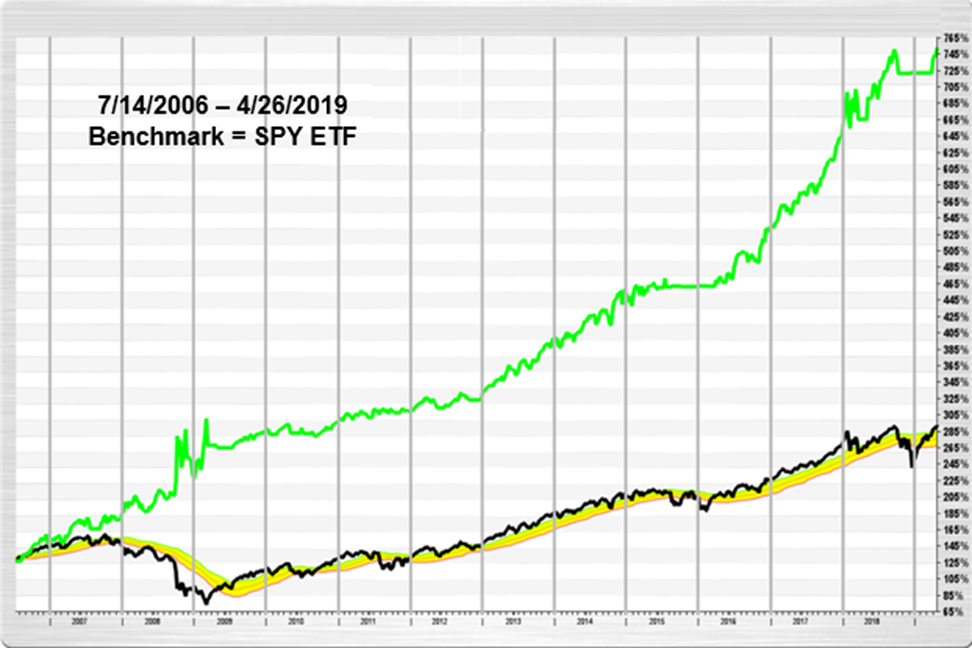

The following is a back test of the strategy I’ve developed going back 13 years which is when these inverse ETFs came into existence. The strategy is simple, but extremely powerful. When the market is in a bullish condition, we invest in one of the ETFs that return approximately twice the gains of the S&P 500. And, when the market is in a bearish condition, we invest in one of the ETFs that move higher by approximately twice the amount that the S&P 500 loses. And when the market is not in a defined trend, we move to cash.

This back test beat the S&P 500 by almost 4-1 over the past 13 years. And, maybe the best part, there were no losing years. That doesn’t mean there won’t be any losing trades. There were losing trades in the simulation and I expect there to be losing trades in actual trading going forward.

But the losing trades are small and the winning trades can go for months at a time. And remember, we don’t care if the market is moving higher or moving lower. This strategy has the capability to make money in both scenarios.

Want to know how to do this? How could a system like this jump start your investment portfolios and get you on track to beating the market? And all while controlling your risk.

On Thursday evening, July 11th, at 7:30pm ET, I’ll be conducting an educational presentation that shows how YOU can know exactly when the market is in a bullish trend and when the market is in a bearish trend. And how to know EXACTLY when to move to cash when the risk is too high. This presentation is open to everyone, but you have to be registered to join us. CLICK HERE TO REGISTER.

The key to beating the market is knowing when to take bullish risk (in bull markets), when to take bearish risk (in bear markets), and when to pull money off the table (in non-trending markets).

Let me show you how to use risk to your advantage. If you’re interested in learning more how my Market-Directional investing works, click here.

Stop guessing and start measuring,

Visit www.turnercapital.com or contact us at info@turnercapital.com.

TURNER CAPITAL INVESTMENTS, LLC

GROWING AND PROTECTING CLIENT CAPITAL IN BOTH BULL AND BEAR MARKETS

IMPORTANT:

Please note the chart referenced above is hypothetical in nature and does NOT represent actual trading. Past performance is not indicative of future returns and all performance numbers noted herein are purely theoretical and do not represent actual trades, the cost of trades, tax consequences or management fees. No recommendation is being made to buy or sell any security. Investing in the stock market involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. Nothing contained herein should be construed as a warranty of investment results. All securities trading, whether in stocks, options, or other investment vehicles, is speculative in nature and involves substantial risk of loss. Turner Capital encourages you to read the investor information available at the websites of the Securities and Exchange Commission at www.sec.gov, the Financial Industry Regulatory Authority at www.finra.org, and the Options Clearing Corporation at www.optionsclearing.com. A critically important aspect of this strategy is how it performs against the S&P 500 index in a bear market. If no bear market is encountered, the performance is much lower than shown in the chart, above.