Through clients, friends, and relatives, I’m reminded that technical analysis is alive and well. Human nature never changes. This is great news for us technical traders. We can use this propensity to our advantage, says Dave Landry. More Trading Lessons every Friday.

Technical analysis: human nature never changes

Let’s explore this further.

Last weekend, a long lost friend stopped by. After we caught up on the obligatory topics of family and business, the conversation turned to the markets. He began talking about how he liked a particular company that he knew very well.

He even knows the CEO and thinks that he’s a great guy (he is) and is doing a great job running his company, especially relative to his competitors. He went on to say that he bought some stock and then he bought more when the stock dropped.

And, when the stock seemed really cheap, he bought even more, thinking that he could flip the shares out and break even.

I told him to refill his beer and meet me in my office.

The first thing I did was to draw a big down arrow over the period of time that he placed his trades. He immediately said that “well, that’s pretty obvious in hindsight.” True, there’s always hindsight when looking back but in his own words he “bought on the way down,” and “bought because it seemed low/cheap,” etc…

Although my representative sample of one might seem a little small, I truly believe this is a microcosm of human nature.

And, human nature never really changes. People tend to buy the familiar. They tend to confuse the issue with facts.

Yes, it might be a great company run by a great guy but the market is the final arbiter. As long as there is more supply than demand for the stock, it will be headed lower.

I emphasized “stock” because a stock is not a company and a company is not a stock. One is a piece of paper and one is a physical entity. A company might be doing great things but if the stock price doesn't reflect that then it's not worth buying.

As my friend has illustrated, human nature also causes people to seek a bargain by buying as a stock drops. In fact, some might even, doubling down aka the "more on" trade (and not trend following moron!), and then seek to look to get out a breakeven. And, BTW, so called Martingale strategies like this are a recipe for disaster.

My definition of trading with technical analysis

Let’s take a step back and define what we are trying to accomplish with charts in the first place. In a nutshell, trading with technical analysis is the use of charts to read the emotions of others while at the same time embracing your own.

Considering the above, the next time you find yourself trying to outsmart the market with numerous oscillators or numerology, remember to first look at a blank chart. Ask yourself: is the stock (or other market) generally headed higher (demand), lower (supply), or just plain sideways (equilibrium)?

The hard and fast rule of technical analysis

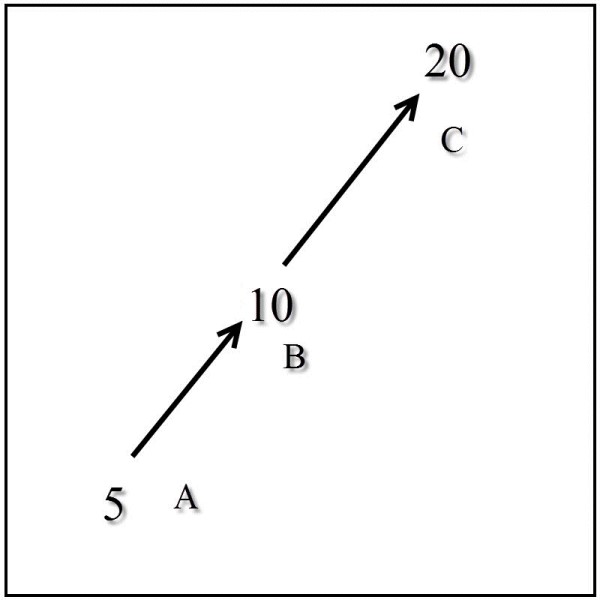

The great thing about technical analysis is that there is a concrete rule (and there are none in any other methods, btw). If C > B > A and a market is going from A to C, then it must pass through point B along the way. True, you can’t always just “buy at B” (although I do have an IPO setup that pretty much does just that), looking to get in somewhere around “B” is a good start.

Once you do establish a trend, then look to get in

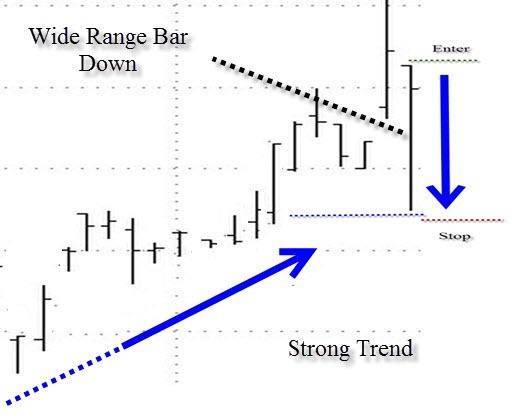

If the stock is in a solid trend, then begin to think about the short-term psychology of those who are late to the game. These “nervous Nellies” are the last-in-first-out players that are most likely to wreak havoc on your new potential trade.

Shorter-term, would the correction be enough to attract some eager shorts? The predicament of these traders can help your new position along, at least shorter-term. The new shorts will be squeezed and those shaken out will be pressured to get back in or be left behind.

Those who are familiar with my methodology may notice that I’m essentially describing the psychology behind my Trend Knockout (TKO) Pattern.

Once these questions are answered then move to the longer-term and ask where might those who have been holding on forever look to bail at breakeven? In other words, make sure that there is no overhead supply nearby that could put a cap on your potential trade.

There's obviously a little more to technical analysis than what’s mentioned above, but if you start by seeking trends and looking for a place to get on them, you're well on your way.

You’ll certainly do much better than just buying things because it’s a company you know or because the stock price is low.

May the trend be with you!

Dave Landry

Dave Landry’s Trading Full Circle course videos and newsletter here