When SPY is above my Transition Zone, I’m bullish and want to be long the market. When SPY is below my Transition Zone, I’m bearish and want to be short the market (or long inverse ETFs), writes Mike Turner this week.

Quick… Where will the markets be at the end of the year? Will they be higher or lower?

You don’t know? But there are all sorts of experts telling you. Just turn on the TV or go to the internet. Of course, some say the markets will be higher and some say they’ll be lower, but that doesn’t matter. They’re experts, right? They should know, shouldn’t they?

Guess what… your answer is the correct one. Nobody knows. The experts certainly don’t know. They’re just guessing.

We all like to guess where the markets will be in the future, but guessing is not a good plan if you’re relying on guesses to make money in the stock market. Guessing adds enormous risk to your investment strategies. Why? You already know what happens if you guess wrong. Wrong guesses result in losses… maybe big losses. You do remember 2008, don’t you?

We could all guess that the market is going to suffer a massive bear market in the future and while there is a 100% probability this guess will be true at some point, what if your timing is off and you get out too soon and miss out on huge gains? In this case, your guess of what will happen is accurate, but the timing is massively wrong.

Fifteen years ago, I was in the same situation that you’re in. I thought that guessing right was the only way to succeed as a stock market investor. I thought the “experts” had a secret formula or maybe just more information than I had. I was consumed with trying to assimilate massive amounts of data (earnings reports, sector trends, geopolitical activities, Washington politics, product trends, etc.).

But I came to realize that even if I had access to all the information in the world, I still could not consistently and accurately predict the future. It just provided me with the ability to make smarter guesses, but at the end of the day, it was still just guessing.

I did discover an amazing fact. I came to realize a fundamental and pivotal truth… All market trends, and all stock price trends, will absolutely, mathematically continue until… they don’t. Ask yourself this question: Do you know how long this current trend in the market will continue? The answer is profoundly simple: The current market trend will continue until it doesn’t. Therefore, all you have to do is stay fully invested in a bull market until that bull market ends, which I have learned to mathematically measure.

Bottom-line: I don’t guess anymore. I don’t have to. I don’t care if we’re in a bull market, bear market, or a transition market. And I might be one of the most successful investors you’ve ever met (and if we haven’t met yet, I’ll tell you where you can meet me in the next couple of months).

Want to know what my secret is? I use math and science to exactly know when to be a bull or a bear or when to sit on cash. I don’t guess, I measure the market.

I call this Market-Directional Investing.

With Market-Directional Investing, I know exactly where the market is. Is it bullish? Is it bearish? By using these algorithms, I know where the market is at any point in time.

By knowing where the market is, and not trying to guess its direction, I know how to invest my money and my clients’ monies.

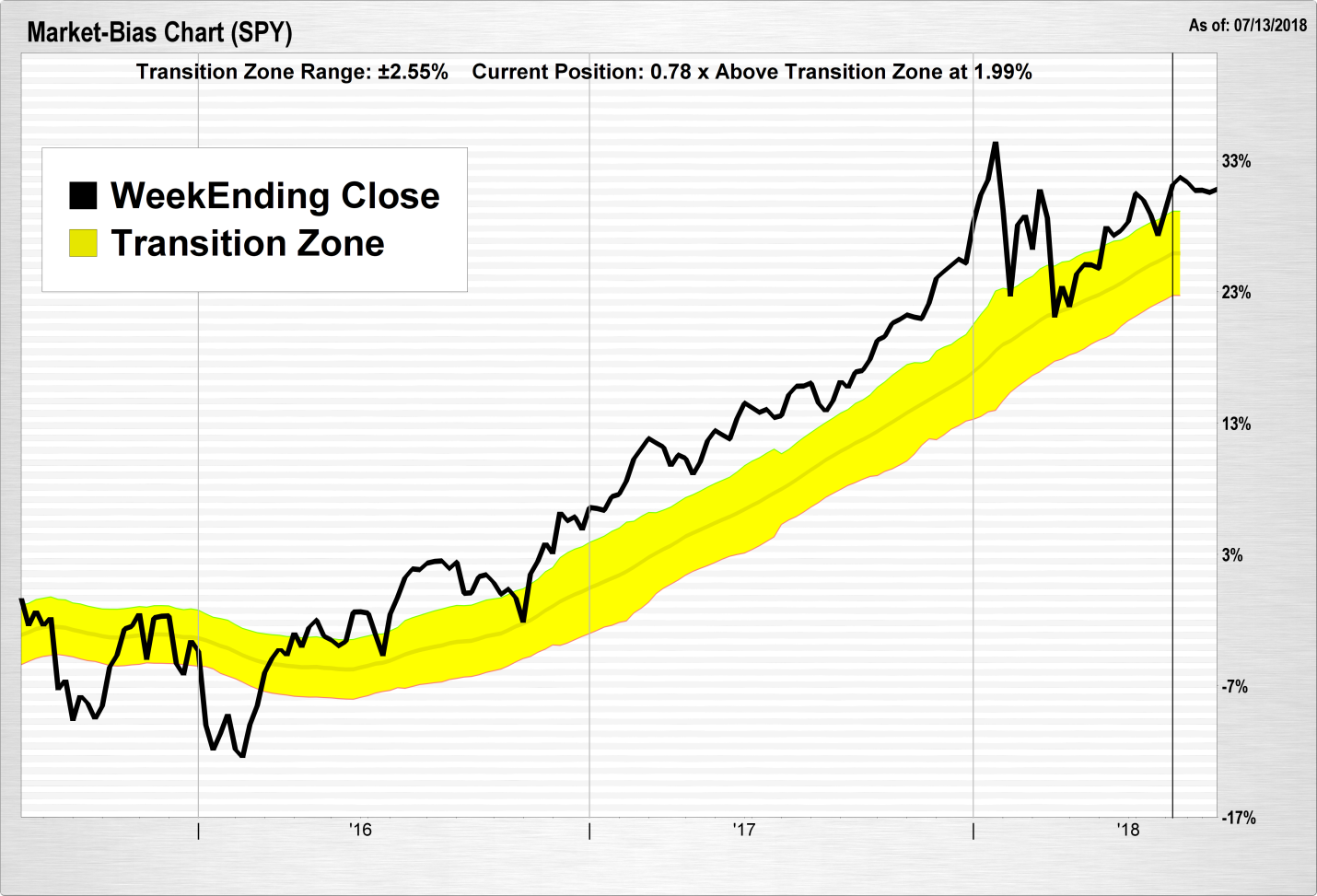

Let me show you an example. Here’s my Market-Directional chart on SPY, the ETF for the S&P 500.

The first thing you probably notice on this chart is the yellow band. I call that band the Transition Zone. The Transition Zone is based on the underlying volatility of the SPY ETF itself.

I use a set of proprietary algorithms to determine where this yellow zone should be on the chart. (Yes, I’m an engineer and software systems architect, in addition to being a wealth manager. I created these algorithms through thousands of hours of testing and re-testing before finally coming up with the investing programs I use to manage money.)

Very simply, when SPY is above the Transition Zone, I’m bullish and want to be long the market. When SPY is below the Transition Zone, I’m bearish and want to be short the market (or long inverse ETFs). And when SPY is in the Transition Zone, I want to be raising cash and patiently wait for the market to tell me what the next move will be.

That makes sense, doesn’t it? Rather than trying to guess what will happen, I just measure what’s happening now and let that guide my investment decisions. You see, the current trend in the market will last exactly until it doesn’t. So, instead of guessing when this current trend will end, I mathematically measure the distance to the Transition Zone and set that as my exit strategy.

I’m excited to share these insights with you each week through MoneyShow.com. I’ll show you more of these Market-Directional charts and explain how they work. We’ll look at indices as well as individual stocks.

I look forward to sharing Market Directional insights with you and helping you become a better investor. Stop guessing and start measuring.

If you’re interested in learning more about how to manage your money using the Market-Directional Investing methodology, you can read more here.

And if you’d like to come meet me in person, I’ll be at these upcoming MoneyShow events:

- The MoneyShow San Francisco – August 23-25

- The MoneyShow Dallas – October 3-5