The Fed just gave you their global view, so its time we take inventory here. Powell raised rates .25% and he said they are on the anticipated path the Fed has been on over the past three years, writes Jeff Greenblatt Wednesday.

He sees inflation risk and the possibility of a weakening economy roughly equal. What that means is they don’t think inflation will get out of control nor do they think the economy is about to rollover either.

The stock market has been incredibly resilient, shrugging off most geopolitical and domestic risk. Given the headlines over the past 10 days, it is remarkable.

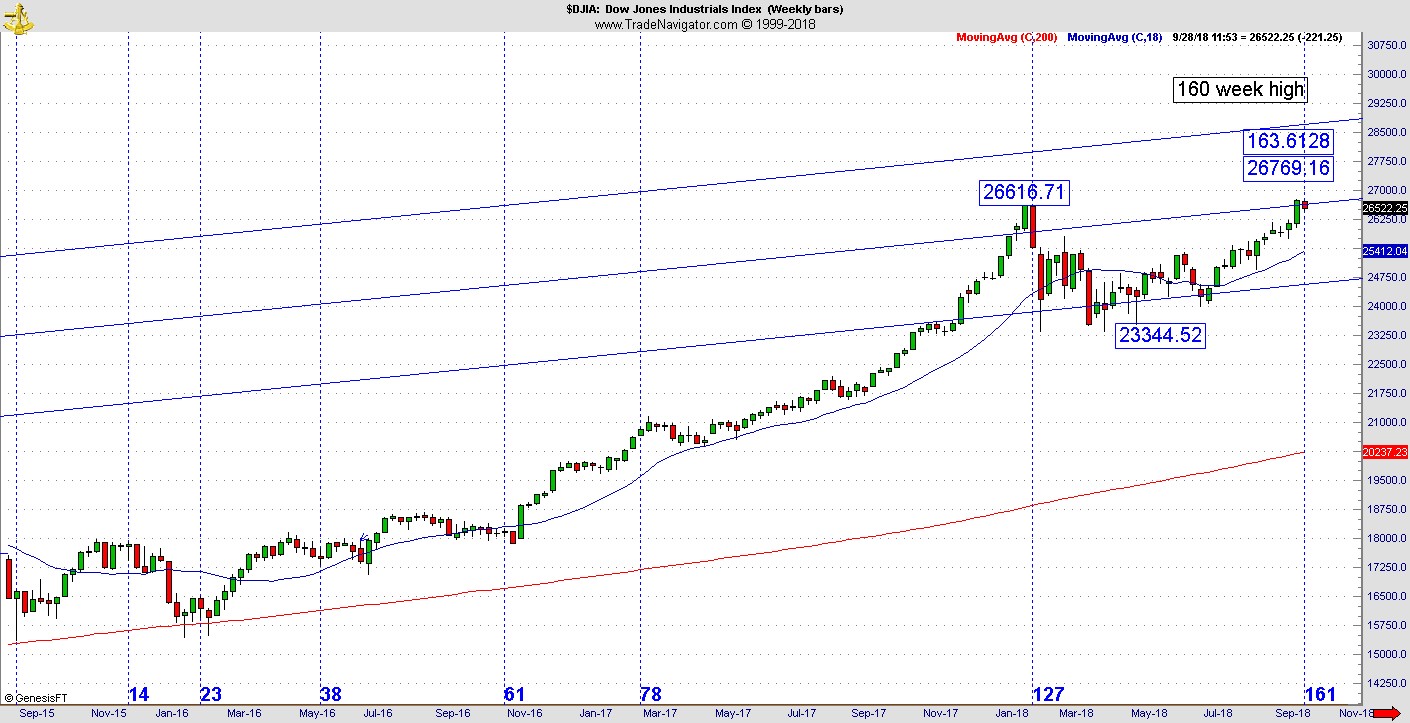

The Dow (DJI) hit a new high above the one in January while tech is lagging. Dow Transports (DJT) has been weakening until today. The only true weak area of the market is still the PHLX Housing Sector (HGX). We discussed the KBW Nasdaq Bank Index (BKX) in recent posts which improved last week but is weakening again since the bond market has slipped lower.

Unless we get a good turn back up in the bond market which has not materialized, expect banking to stay weak. Unless banking and housing improve, these are going to be the Achilles’ heel of the stock market. The initial knee jerk reaction to the rate hike was higher.

I think we have a market that does want to go higher but there is a caveat. First of all, we have another time window right here. The Dow peaked at 610 days from the August 2015 bottom back in January. Now it is 161 weeks from that low, likely the last high-risk time window of this season where stocks are most vulnerable. The epicenter of this cycle point is Friday through Tuesday which is 161 days (+/-1) off the February low for the S&P 500 (SPX).

Headline risk is incredibly high. We are in a season Americans have never seen before. Last Friday the New York Times leaked a story about comments made by Deputy AG Rosenstein. You’ve heard about it. The Supreme Court nomination process is now next level compared to what we experienced with Anita Hill and Clarence Thomas. The president has ordered FISA documents to be declassified which may shock the nation.

These are historic events. Markets may want to go higher but might not be able to do so if conditions take a wrong turn. As we learned this is the “Eyes Wide Shut” market. Life goes on…until it doesn’t. But you knew that. The market will carry on until it takes it personally. What might that be? Anything that messes with this booming economy.

Over the past year, I’ve chronicled any number of events which could’ve gone off the road but didn’t. The biggest one was the North Korean situation where many anticipated the worst-case scenario which never materialized. Headline risk is going to remain high through the November election. Right now, this weekly cycle point extends through the end of next week.

As far as precious metals are concerned, they inched higher until they came to the ultimate inflection point to confirm the bottom but couldn’t do it yet. They continue to defend the lows but can’t break through to the point we can project the lows are secure.

In other words, they’ve gone through a process of some bears covering shorts which put the initial upward pressure on the pattern. On the other hand, there is always a transition period where a market grows from short covering to legitimate buying.

Precious metals are going through one of the more spirited debates between bulls and bears that we’ve seen in a long time.

There is a lot to digest.

Risk remains high as a historically complacent market collides with pure history itself.