Recent and upcoming stimulus measures from the Chinese government will likely result in a reacceleration of Chinese GDP growth, writes Tim Shirata, EVP Guild Investment Management.

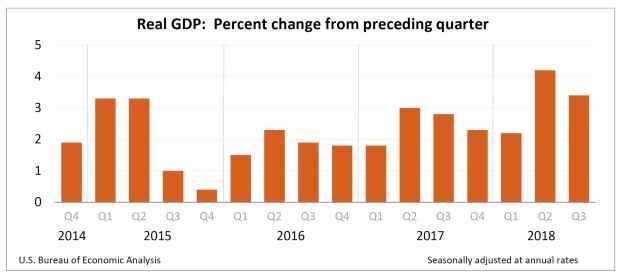

The partial government shutdown in early 2019 has delayed the Commerce Department’s official report on fourth-quarter U.S. GDP growth until Feb. 28. In the absence of official data, polls of economists are providing some picture: about 2.6% annualized real GDP growth in the quarter, bringing full-year 2018 real GDP growth (that is, taking inflation into account) to approximately 3%.

The same polled economists are predicting 1.8% real growth in the first quarter of this year, accelerating to 2.5% in the second quarter. Economists flag the last quarter’s market turmoil and concerns over global growth (particularly Chinese growth) as the elements responsible for 2019’s deceleration from the 3% pace set during 2018.

To us, the salient point is simply the one noted by an economist who specializes in retail data: “I don’t think we’re seeing anything that we can measure at the macroeconomic level… that would point to any downturn.”

We believe that recent and upcoming stimulus measures from the Chinese government will likely result in a reacceleration of Chinese GDP growth in the second half of 2019. As we often say, stock markets are discounting mechanisms, and Chinese markets are already beginning to reflect an anticipated positive growth inflection.

Investment implications:

Although U.S. GDP growth decelerated in the last quarter of 2018, and is likely to continue at a slower pace in the first two quarters of this year, we anticipate that the ongoing health of U.S. corporates’ earnings and U.S. consumers, and the reacceleration of growth in China later in the year, will support markets’ continued progress. Despite the duration of the current expansion— 10 years this summer — we do not see signs of imminent recession.

The U.S. Economy and Markets

In spite of slight deceleration from the GDP growth rate posted in 2018, the U.S. economy continues to be strong, and we anticipate that as 2019 unfolds, growth will strengthen. U.S. markets have rapidly recovered from their fourth-quarter swoon, and while we believe that there will continue to be volatility in 2019, corrections will likely be shallow and brief.

The United States has about 7.5 million unfilled job openings, a decade-and-a-half high. Corporate profits are growing, and the U.S. consumer is healthy.

We are optimistic, where our favored sectors and industries include the usual suspects: High-growth technology stocks in software, cloud, and AI, which can save money for corporates and growth their earnings consistently. We are particularly alert for stocks which have been punished in recent months and whose prices have become more reasonable.

Asian and Latin American Opportunities

We are beginning to be bullish on China. As we often say, stock markets function as discounting mechanisms; we believe that Chinese growth will trough in the middle of the year, and then begin to reaccelerate in response to stimulus measures from the central government. Chinese stocks have been rising, likely in anticipation of these developments.

Within Asia, we see some opportunity in Japan and in India. While India remains a long-term growth opportunity, near-term developments will depend on continued progress in reforms from the Modi administration, and on local election news and deal making.

We are still bullish on Brazil. Although Brazilian markets have moved strongly since the election of Jair Bolsonaro in October, we believe that the new president will be able to move quickly to address pressing problems in Brazil, particularly entitlement reform, anti-corruption efforts, and law-and-order policies to improve Brazil’s disastrously poor public security. Particularly if he succeeds in reforming Brazil’s unsustainable pension system, international capital will applaud and will begin to flow back to Brazil more rapidly. We are attentive to opportunities also elsewhere in Latin America.

Europe

Some stocks in Europe are showing signs of life, but given the poor overarching business, financial, and economic conditions in Europe, we remain cautious.

Gold

We remain modestly bullish on gold and on some gold-mining shares. Many of the world’s central banks are stepping up their gold purchases. Even if progress is made in global trade negotiations, there is likely to remain an undercurrent of uncertainty which could encourage gold demand. Gold has underperformed for many years, and if the U.S. dollar remains cooperative, we could see further appreciation in gold this year.