While volatility is all around, the market is being supported by dovish central banks, notes Joe Duarte, Editor Joe Duarte in the Money Options.

The late Marty Zweig often said: “Don’t fight the Fed, and don’t fight the market’s momentum.” And this market is offering a perfect opportunity to heed those words of wisdom.

I’m not blind. And this market with its volatility and its robotic trading signature surely gives me the willies. Yet, with the upside momentum displaying a full reversal of the terrible pace and direction of the Q4 massacre, the opportunity to make money is too good to pass up for now.

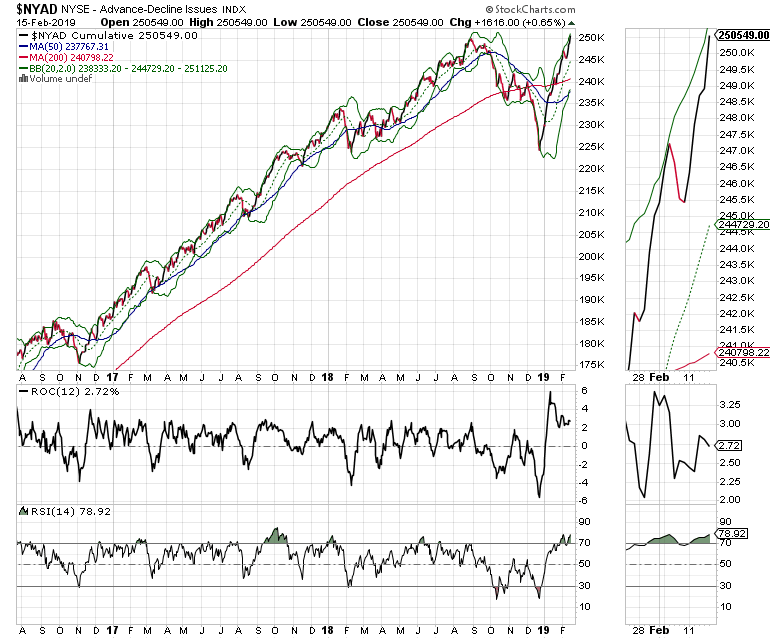

Accordingly, it’s hard to be bearish with the new high on the New York Stock Exchange Advance Decline line this past week, which signals rising momentum to the up side. Thus, for now, the path of least resistance, albeit with some scary bumps in between, seems to be up.

Here are the big picture points to consider:

- This is the third year of the Presidential Cycle, a traditionally bullish year for stocks

- The odds of a global central bank easing cycle are rising

- This is a momentum market fueled by expectations of lower global interest rates

- Headline risks persists: Think U.S.-China trade war, slowing economic data, earnings

- Technology (XLK) and Emerging Markets (EWZ, EWA, EWM, EWS) remain attractive

- The rally is broadening: Think Biotech (BIB), Banks (XLF), and Big Pharma (XLV)

- Volatility is here to stay

Hopes of Lower Interest Rates Fuel Stock Rally

Among the most bullish reasons for higher stock prices are the central banks that are clearly recognizing the global economic weakness and are hoping to avert a repeat of the 2008 market crash and the Great Recession, or worse. Thus, they are priming the monetary pump with news of the European Central Bank considering another round of quantitative easing even as the central bank of China is aggressively loosening monetary policy hitting the wires this week as the Fed holds pat.

Moreover, the big banks are not alone, as the central bank of India recently cut rates while the odds of other central banks such as Australia joining the party are rising. Indeed, recent comments from Australian bank governors have hinted at a change in the direction of rates, likely to the down side as the Australian economy is slowing along with China’s. Most important, while the Federal Reserve is on hold, news surfaced this week that the U.S. central bank may consider ending its balance sheet unwinding by the end of 2019, a factor which would further reduce pressure on market interest rates.

Altogether, the scene for what may be an aggressive round of global central bank easing, led by China, seems to be unfolding. This is important, not just for the global economy, but for the stock market because the robot trading algorithms, the ultimate momentum traders, are programmed to buy stocks, regardless of the valuation, as long as the interest rate environment is considered to be positive for stocks and there are buy orders coming in. Remember that the advance in stocks from the 2009 bottom until the mini-bear market of 2018 was fueled by lower interest rates and by corporate stock buybacks, which are back on the front burner and contributing to the market’s current rally.

History May Be Repeating

Historically speaking, this market is being compared to that of 1991, which happened to be a third year of a presidential cycle and when the U.S. partook in Gulf War I. During the first quarter of 1991, the S&P 500 rose 16%, 11.26% in January alone. Just as in January of this year, the rally was preceded by a prior and sizeable decline which began in August 1990 as the Gulf War situation, prior to the deployment of U.S. forces into Kuwait, materialized. During that bear raid in 1990, the S&P 500 was down over 15% in a bruising decline. 1991 was one of my best trading years ever.

Flash forward to 2018-2019 and we have a parallel situation where a bruising late year bear raid caused by expectations of a trade war between the U.S. and China led to what is currently a bear crushing rally in January and February.

Interestingly, the Federal Reserve began a rate lowering cycle in January 1991 after having raised interest rates from 1987 to 1989 and keeping them stable until the Gulf War.

New High on Market Breadth

The New York Stock Exchange Advance Decline line remains the most accurate indicator of the stock market’s trend, as it has been since the 2016 presidential election, which is why its new closing high on Feb. 15 is a positive development for the bulls. Indeed, the new high, barring a severe reversal in the near future, suggests that the trend for stocks has now been fully reversed after the Q4 bear market.

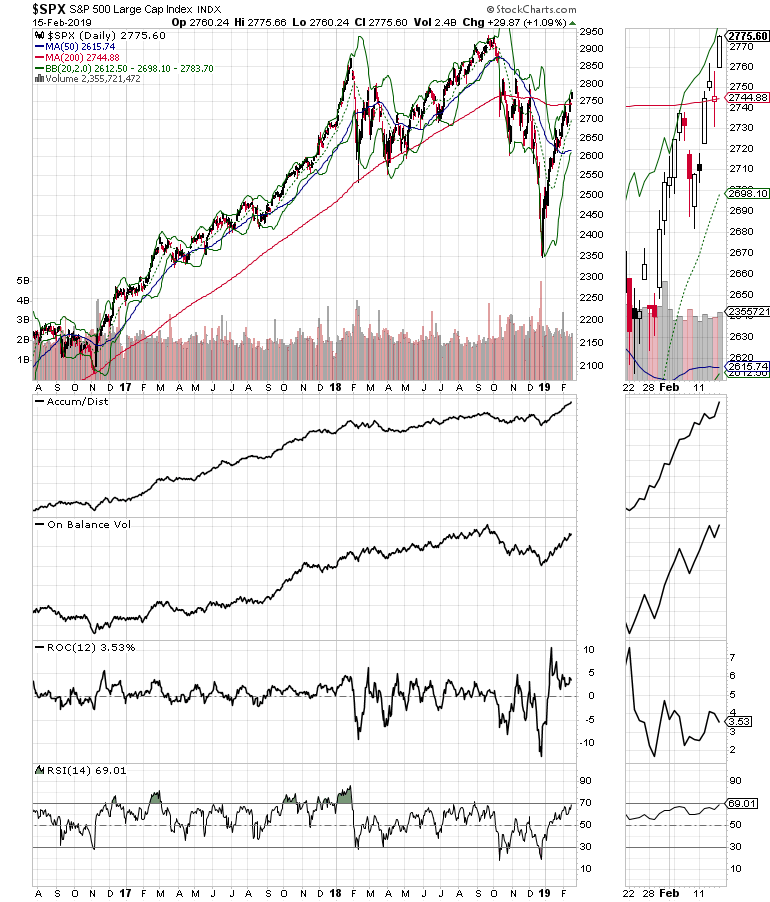

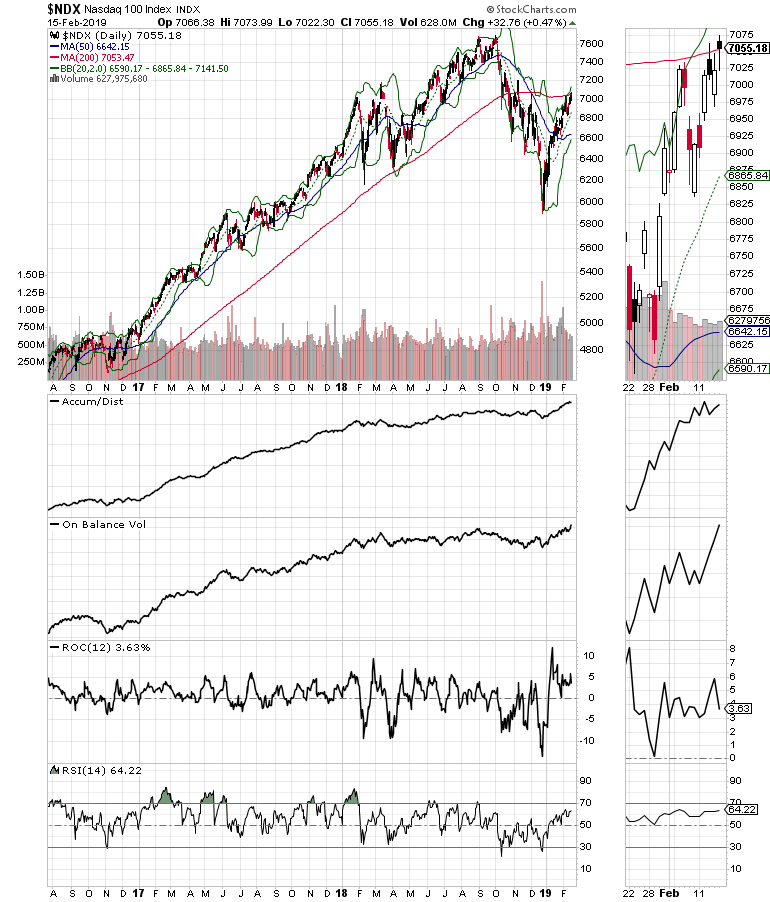

Meanwhile the Nasdaq 100 (NSX) and the S & P 500 (SPX) have both crossed back above their 200-day moving averages, at least partially confirming the action in the NYAD.

Both indexes are nearly overbought based on the Relative Strength Index (RSI) and overdue for a consolidation which could come at any moment. But that consolidation may not come for a while yet, given the fact that the On Balance Volume (OBV) and Accumulation Distribution (ADI) indicators are still rising while ROC, which measures momentum is not overheating.

Thus, with the rally broadening, the bulls may still get a couple of more weeks of high momentum trading before some type of slowing makes its way into the market.

Don’t Trust this Market. Just Trade it.

Don’t be fooled by the market. It’s not your friend. It will eventually betray you, as it always does. But for now, it’s foolish to fight the central bank fueled momentum as all indications suggest that the path of least resistance is up. Furthermore, there are still plenty of doomsayers out there calling for the end of the world, which gives rise to more short covering as the market rises. Accordingly, even though there are no guarantees, history seems to be on the side of the bulls at the moment, given the historical parallels of the current time and 1990-1991.

Of course, the bears may eventually be right, maybe even tomorrow as the market loves to make fools of us all. The market will be watching for the effect of any easing and it won’t be patient if the data fails to turn around. But for now it makes sense to stick with what’s working and ride the rising tide in the short term. But due to the market’s rally, hedging is very inexpensive. Thus it is worth looking at in order to prepare for that inevitable reversal, which may be just around the corner.