Yesterday we described how Kairos is defined as the supreme or most opportune moment. Merriam-Webster defines it as the time where conditions are ripe for the accomplishment of a crucial action. For the trader, there is never a time more important than the point where risk is lowest and potential for movement is greatest. It is the point in time where price and time square out. Many years ago, Gann coined the term. He said a stock had to move in a specific way over a period of time. For instance, Citigroup could be at 40 and for price and time to square, it should move to 80 (40 points) either in 40 days, weeks or months.

In “Gann: Understanding the Kairos Moment” we went into Gann methodology and provided examples from 2016. Here we show how this played out in the most recent equity correction and rebound.

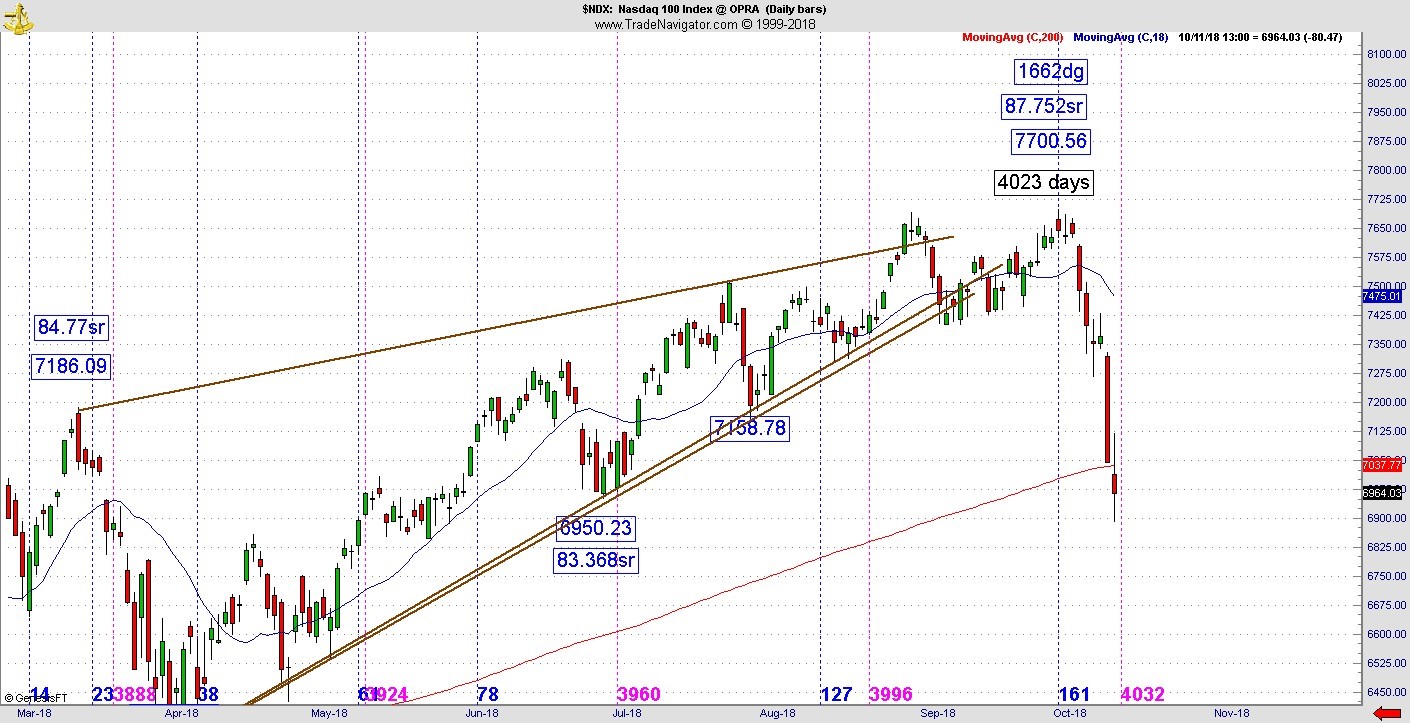

Let’s look at how the stock market topped in 2018. This was the signature of the top and anyone who could recognize this realized something extraordinary was developing. Back in 2002 in the old internet bear, the NDX had a range of 4021 points. As it turned out, the 2018 top had a vibrational square out at 4023 days (see charts below).

This sounds too good to be true. Does it always work out this way? In many cases, this method produces reactions that are small and the trader will get stopped out. However, over the bigger picture many moves materialize from these kinds of vibrations. The idea is to let the better moves run in order to get to the point where the winners are big enough to leave enough on the table to cover the small losers. To catch the bigger moves, this methodology should be combined with the strategic goal of catching the vibration at a key retest of support or resistance.

This is for people who are content to take points out of the market. Due to the lack of good training in the industry some people will have a hard time accepting this is really what is driving financial markets. Many have been raised up in this business to believe news events or earnings/fundamental reports drive the action. But cycle analysts realized long ago that when the time window matures, the news event materializes.

The vibrational methodology works the same way. A trader goes through a process of learning how to recognize opportunity before trading with real money. Practice is the key to renew the mind to realize what one sees on a study chart is materializing in real time. While no two patterns are ever alike, the tendencies are like snowflakes, they repeat over and over. Have patience, go slow and learn a few tendencies at a time. Make mistakes on a simulator. Professional athletes go to training camp and after a few weeks get bored. They go to the next level with preseason games. Those who do well with preseason move on to prime time. Be sure you know what you are doing before you try real money.