Hogs still in play, soybeans a little murky, says John Rawlins.

The QuantCycles Oscillators offers some imperfect opportunities in the ag sector this week.

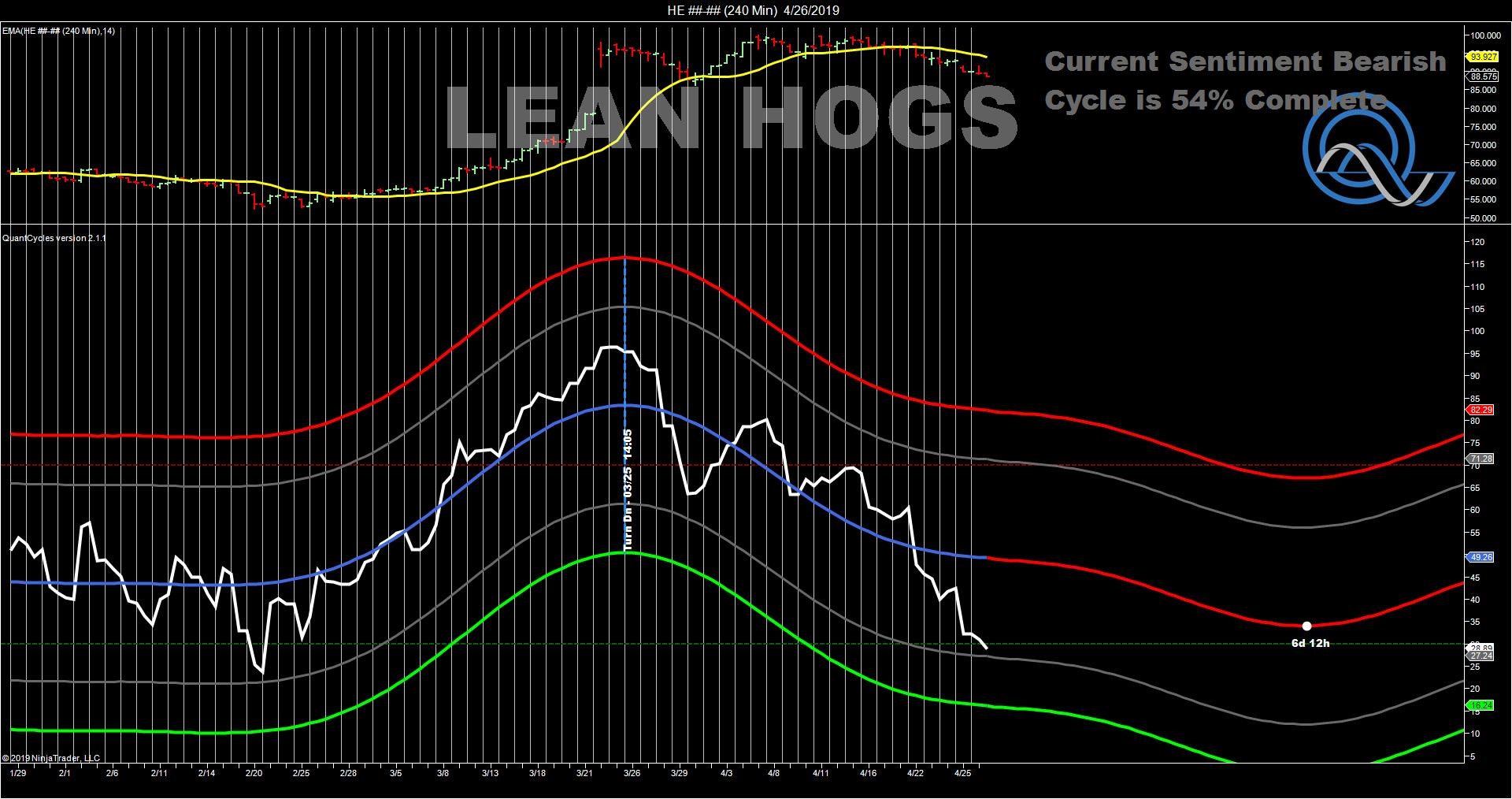

Following the sharp rally in lean hogs last month (that was predicted here), hogs moved into overbought territory on the long-term QuantCycles Oscillator (see chart).

Hogs have subsequently began to move lower as also cited here. While no longer in extreme overbought territory, the QuantCycles charts indicate that lean hogs will continue to weaken this week.

While the weekly chart (above) shows sustained weakness, the daily and four-hour charts (below) indicates that traders can get short, but may want to take profits by the end of the week.

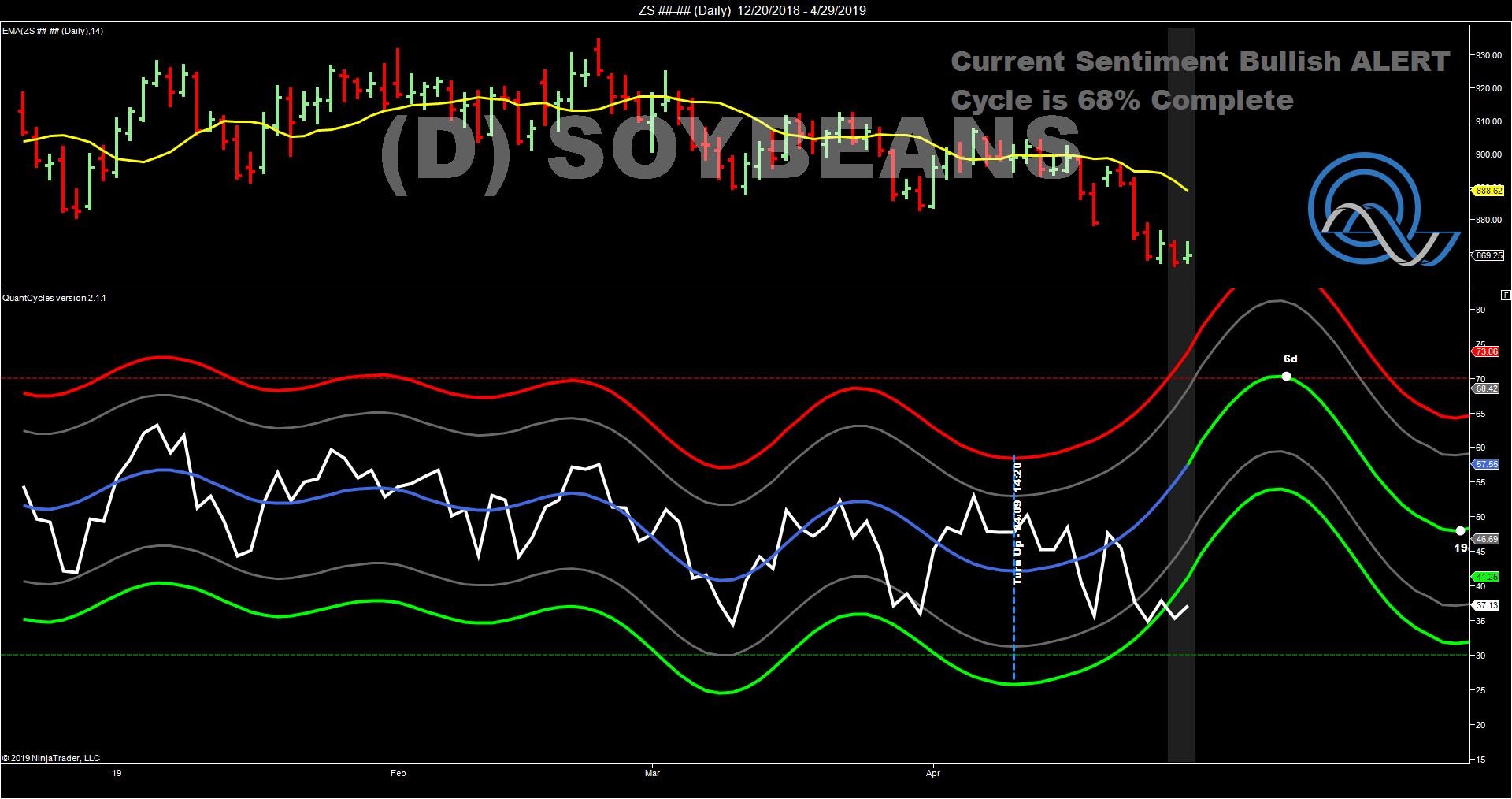

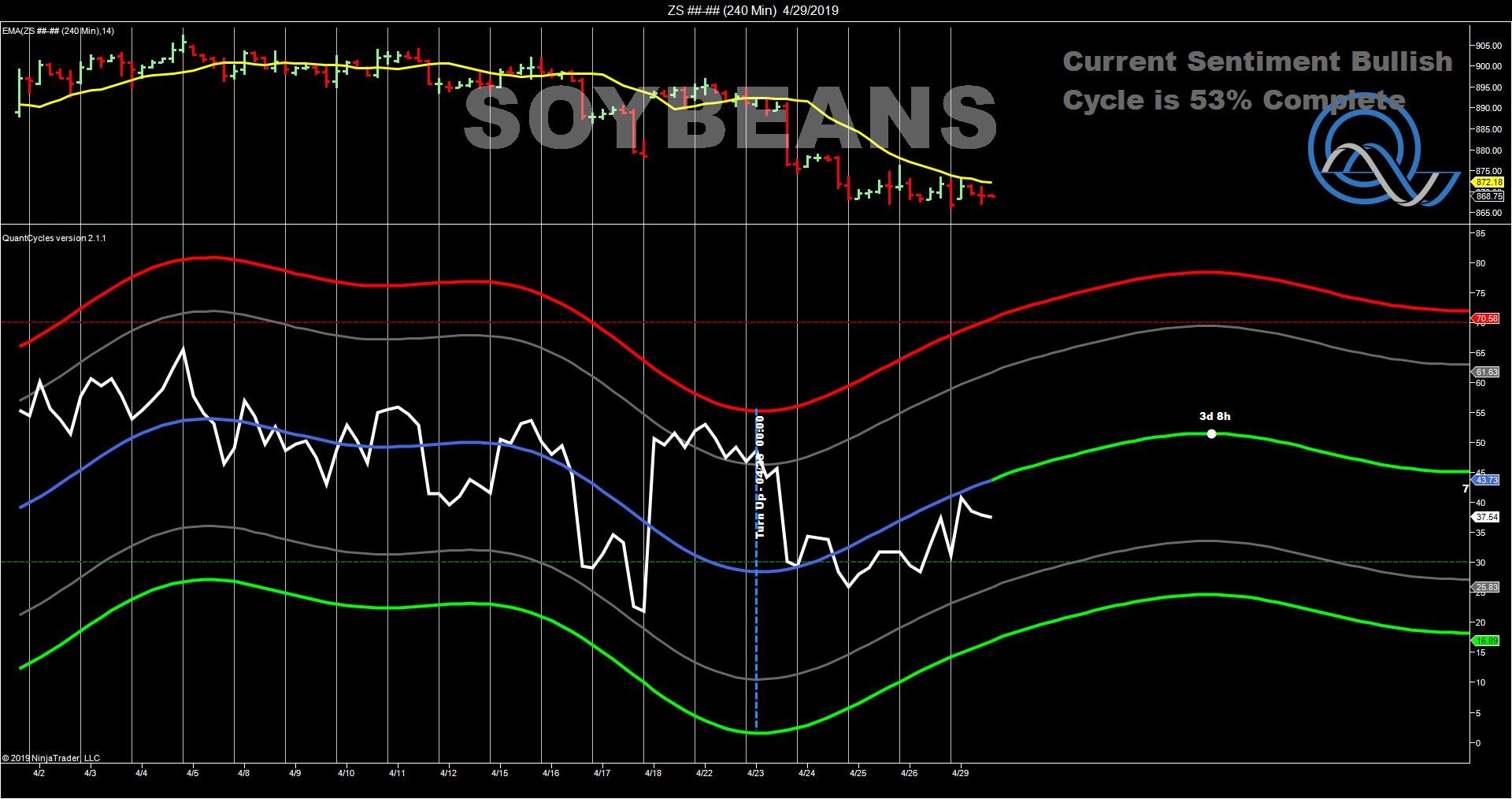

Soybeans

The daily QuantCycles oscillator shows that soybeans are extremely oversold and headed sharply higher.

While the four-hour chart confirms the direction, it is not oversold as with the daily. The long-term chart does not offer confirmation. In fact it indicates longer-term weakness. Soybeans may be a short-term buying opportunity, but speculators should not get married to the trade and look to bank profits by the end of the week.

Update

Last Thursday we recommended a somewhat peculiar spread, buying Amgen (AMGN) and selling Coca-Cola (KO). The spread worked, though KO has quickly regained its losses.

John Rawlins described the value of the QuantCycles Oscillator recently at The Orlando MoneyShow.

The QuantCycles indicator is a technical tool that employs proprietary statistical techniques and complex algorithms to filter multiple cycles from historical data, combines them to obtain cyclical information from price data and then gives a graphical representation of their predictive behavior (center line forecast). Other proprietary frequency techniques are then employed to obtain the cycles embedded in the prices. The upper and lower bands of the oscillator represent a two-standard deviation move from the predictive price band and are indicative of extreme overbought/oversold conditions.