Ever since equities corrected at the end of 2018, a specific group of “safe” investments have exploded in value, have you exploited this trend, asks Mike Larson.

It’s the greatest story that’s not being told. The tale of amazing, unheralded, outperformance of “Safe Money” investments. And I’m determined to change that because it could make a dramatic difference in the performance of your portfolio for the rest of 2019 and far beyond.

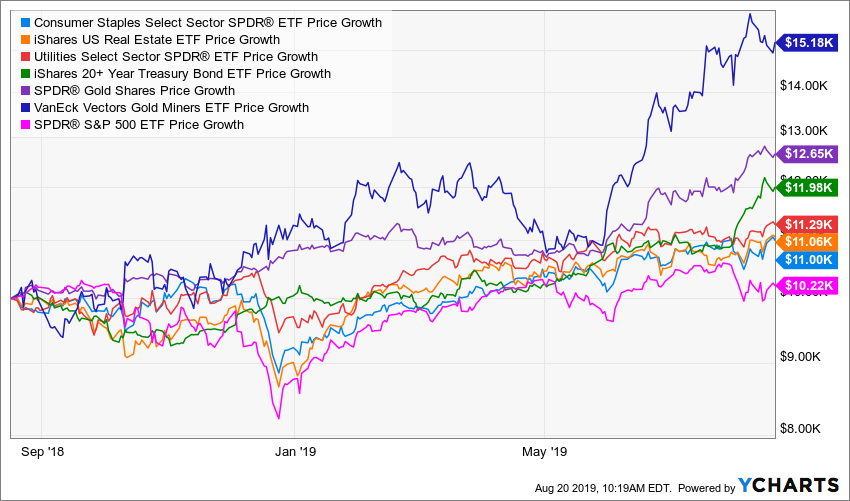

The facts are undeniable. They show that over the past year, you’ve basically made squat if you just owned exchange traded funds (ETFs) or mutual funds that track the S&P 500. The SPDR S&P 500 ETF (SPY) is up by only around 4% in 12 months. Buy during that same time frame (as of Aug. 20:

- The Consumer Staples Select Sector SPDR Fund (XLP) and the iShares U.S. Real Estate ETF (IYR) are both up 14%, around 3.5x more than the S&P 500.

- The Utilities Select Sector SPDR Fund (XLU) is up 17.5%, about 4.4 times the S&P 500.

- The iShares 20+ Year Treasury Bond ETF (TLT) is up 21%, 5.3x the S&P 500.

- As for precious metals, fasten your seatbelt! The SPDR Gold Shares (GLD) is up 26%, while the VanEck Vectors Gold Miners ETF (GDX) has soared a whopping 50.5%. That’s 6.5x and 12.6x the gain in the S&P, respectively (see chart below)!

Caption: If you invested $10,000 a year ago in almost any Safe Money sector or ETF, you’d have much more money now than if you had just invested in the S&P! Note: Profit figures vary slightly from article copy due to slightly different calculation dates.

Bottom line?

There is a raging bull market in “Safe Money” investments, the kinds of things we have been discussing here and recommending in our Safe Money Report.

In fact, two of my favorite stocks in the utility and Real Estate Investment Trust (REIT) spaces just hit all-time highs yesterday.

You hear very little about these trends on financial television. You read little about them online or in print media. Why? Because utility, consumer staples and REIT shares aren’t “sexy.” Neither are Treasuries or gold. They’re boring.

Talking about them doesn’t generate big viewership or ratings. And Wall Street firms would rather you buy their latest money-losing tech IPOs than stodgy utility stocks because the former generates bigger fees and commissions.

But my job is to find you winning investments any place I can! And ever since early 2018, when the market environment began to change (as I explained at the time), Safe Money-style investments have absolutely crushed the averages.

Would you rather hear about (and own) sexy stocks that are going nowhere — or worse, losing value? Or safer, “boring” stocks, bonds, gold and other defensive investments that are up 14%, 17.5% or more than 50% in a year?

My advice? Tune out the hype and hysteria you’re hearing elsewhere. The winning stocks and sectors you aren’t hearing about from others are exactly what you ARE learning about here from Weiss Ratings. You have my commitment that won’t change.

Our Safe Money strategies have been working out great for subscribers who are following the model portfolio recommendations. You can join them by click on this link: Subscribe to Safe Money Report here…

If you want to know more about how to generate gains like these, you can catch me at the MoneyShow Philadelphia, Sept. 26 to Sept. 28 at the Philadelphia 201 Hotel.

I’ll also be presenting at the MoneyShow Dallas, Oct. 13 to Oct. 14 at the Hyatt Regency Dallas.

I hope to see you in person at one or more of these events soon!