Equity Bulls are in Control, but Stocks are in a Bullish Mood and are caught between the Fed’s Liquidity Push and that Pesky Bond Market.

This remains a rising and momentum building stock market for now as the Federal Reserve’s repo operations are flooding the system with liquidity. Meanwhile the selling in the bond market and the subsequent rise in yields is creating a sector rotation and does have the potential to derail the rally if yields rise far enough. Nevertheless, for now the trend in stocks remains up so investors who follow the money should continue to profit, barring an acceleration of the rise in bond yields.

Liquidity is the Lifeblood of Momentum

The Fed’s third consecutive rate cut has ignited a rally, which has led to new highs in stocks as the bond market’s aggressive sell off has changed the entire momentum scenario for traders and may be a major negative in the not too distant future if it remains unchecked. Specifically, for the past several months investors in homebuilder and dividend stocks have done quite well, but rising bond yields have triggered a major rotation out of those former darlings into industrial, financial, some energy names, and even some retailing stocks.

Interestingly, these economically sensitive stocks are rallying in the face of fairly dull economic data, which doesn’t really add up, unless traders are betting that the U.S. economy will start to grow aggressively in the next few months. More likely, however, we are just seeing robot traders following their scripted program instructions based on technical parameters.

Therefore, the danger is in the possibility that if reality doesn’t catch up to the algorithms, things could reverse in a hurry. Certainly we can argue about the pros and cons of the rally and the reasons for rising stock prices, but for now it’s best for traders to follow the money while being aware of the risks.

The Changing Landscape

Perhaps the most concerning aspect of the higher bond yields is what will happen when investors who own negative yielding bonds capitulate as they dump their massive losses, which if left on their books, will impact their end of the year results and bonuses. If this happens, it could lead to panic selling in the bond market, which could be fueled further by algos creating a potential global market mess.

Thus, the question is whether this rotation in the stock market is a signal of a potential evolution to a climactic end to the bull market as cyclical stocks, which are often among the last groups to rally in a bull market make their move or whether it’s just another extension of the longest lasting bull market party in history.

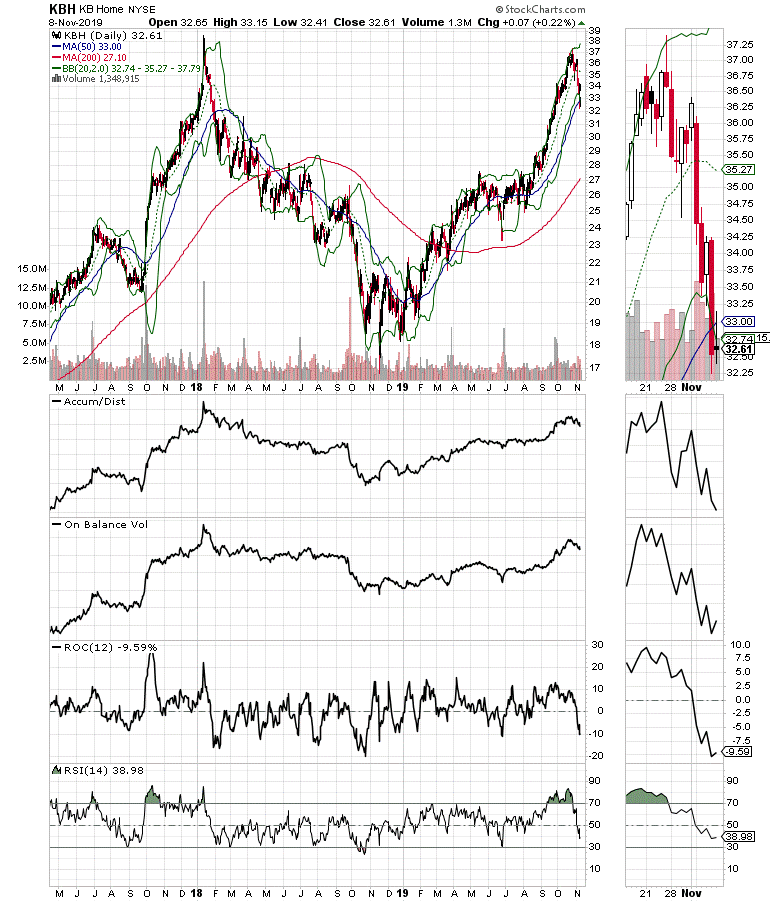

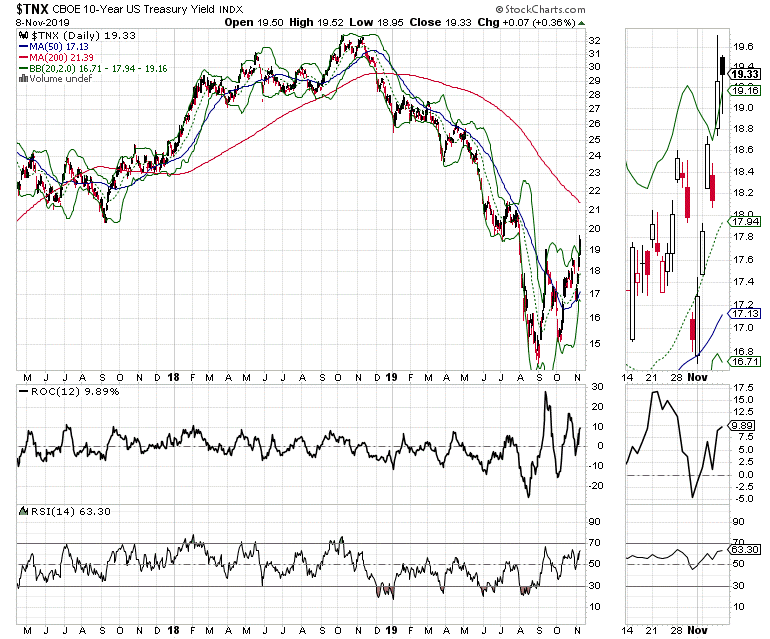

Moreover, while bonds are a point of worry the stock market doesn’t seem to mind higher yields much at the moment and is instead engaged in a sector rotation. A perfect example of the changing landscape in stocks is the rotation away from interest rate sensitive stocks, which have delivered big wins this year, such as homebuilder KB Homes (KBH) whose shares have reversed course after a nifty nearly 100% gain for 2019 and which seems headed lower in a hurry as the U.S. 10-year note (TNX) yield flirts with the 1.9% area (see charts below). Of course, KBH shares were clearly due for a pause after such heady gains. But the real question is whether this signals a potential change in consumer behavior towards home purchasing.

Accordingly, we could see a scenario where those millennials and empty nesters that have been gobbling up well priced, well located, and full of perks KBH homesteads at low interest rates may not be as willing to take a chance with mortgage rates above 5% as they were a few weeks ago when they were closer to 4%. Thus, the next set of mortgage and housing data should give us a sign as to whether this is a significant pivot point in the Markets–Economy–Life (MEL) adaptive complex system.

If home buyers are not put off by higher rates it could signal that in a market with tight supply the gains in their 401(k) plans from the stock market and the feeling of job security are good enough to keep them interested in taking a chance on buying a home. Nevertheless, there may be some significant economic impacts from this scenario if it fully develops in the not-too-distant future. Indeed, since housing is a significant chunk of the U.S. manufacturing sector, it is plausible to expect a potential hit to GDP if home sales start to falter due to higher mortgage rates.

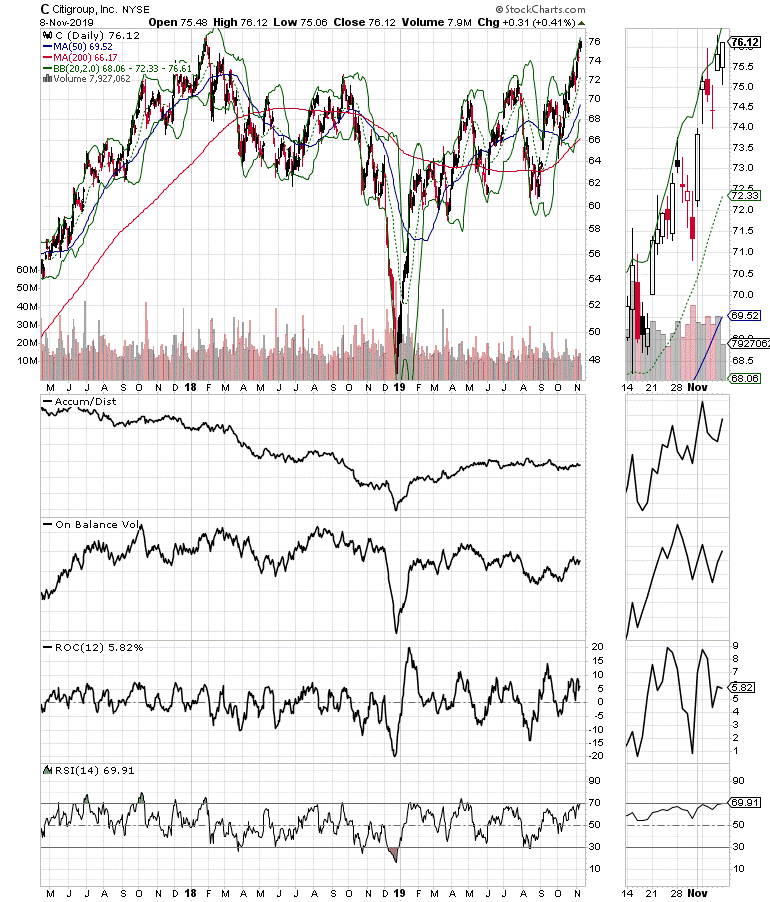

Meanwhile, financial stocks, such as Citigroup (C)have broken out and seem to be building momentum. The rationale is that higher bond yields will increase the interest income for banks and increase loan volumes. Of course, if there are fewer takers on mortgages, and if the expected demand in business loans that the Fed is hoping for via its liquidity push doesn’t materialize, the whole thing may come crashing down.

The bottom line is that the bond market, and its relationship to the Fed, hold the key to how things may work out. Moreover, if bond yields rise to the point where the housing sector rolls over, the economy will also likely start to slow. In that case bond yields could reverse and the cycle is likely to repeat in favor of the homebuilders unless a slowing economy leads to job losses, which is something that may be starting to happen around the fringes at the moment.

Market Breadth Remains Bullish

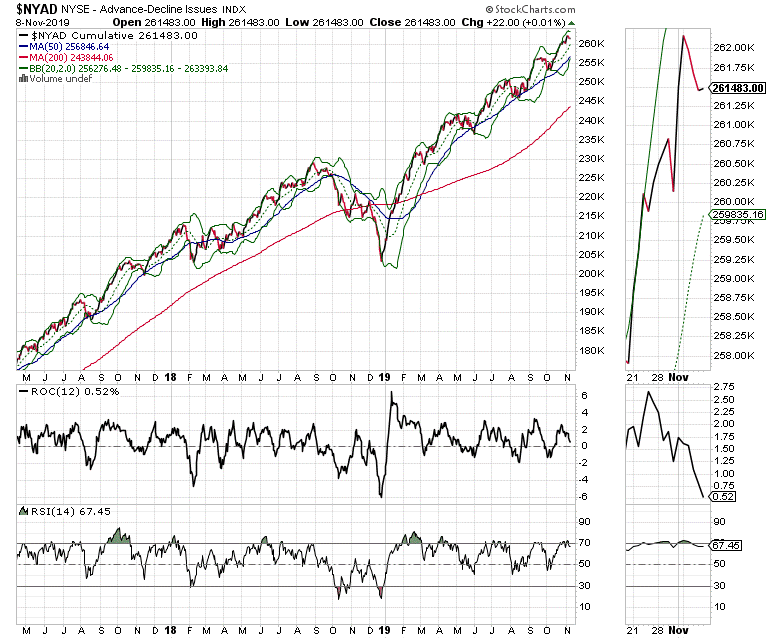

The New York Stock Exchange Advance Decline line (NYAD) remains the most accurate predictor of the price trend for U.S. stocks since the 2016 election. So far, as NYAD makes periodic new highs and remains above its 50-day moving average on pullbacks, stocks continue to move higher over time. And the past week was no exception as NYAD made another intra-week high although it rolled over slightly on Thursday and Friday after recently testing support at the 50-day moving average. For now, the trend remains up as the Fed’s liquidity injection continues to boost stocks and NYAD remains in its bullish rising channel.

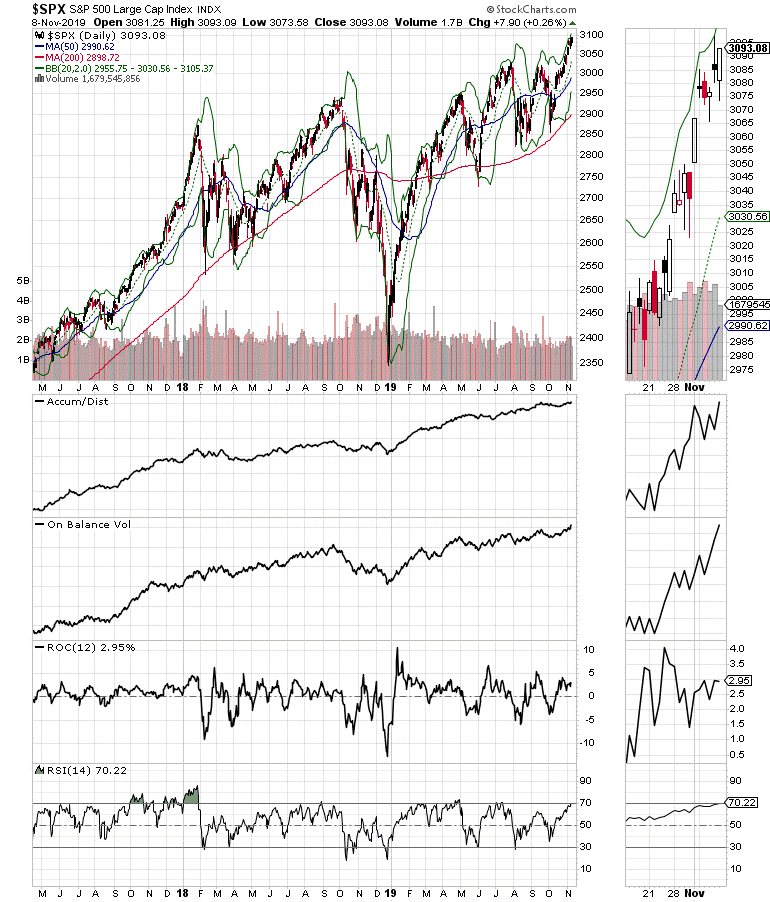

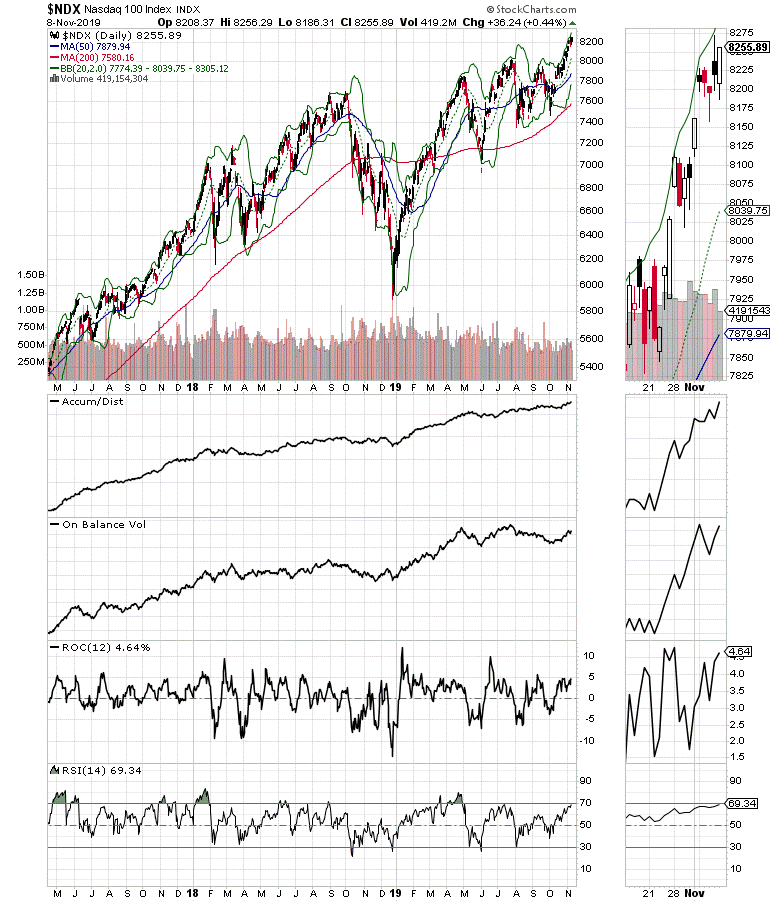

The action in NYAD has been contagious as both the S&P 500 (SPX) and the Nasdaq 100 (NDX) indexes made new highs last week confirming the NYAD in an event which could bring in more money to the stock markets as traders fear missing out on the rally.

Indeed, we are witnessing what could be the early stages of a yearend momentum run which could take the market up another 3-5% or more before things calm down or reverse violently.

For now, however, the bullish trend in NDX and SPX is confirmed via the uptrend in both Accumulation Distribution (ADI) and On Balance Volume (OBV).

The stock market seems to be in the relative early stage of a new momentum run, which could take stocks significantly higher before the end of the year as the Fed pumps money into the repo market. As usual with all such market events, this momentum run will end badly. But for now, there is no point in fighting the liquidity fueled uptrend, although the bond market may have other thoughts in mind.

oreover, the positive aspect of the rally is that there are still plenty of bears who are calling for a market crash. However, as things develop and more people turn bullish the odds of more gains will diminish and eventually there will be a reckoning.

The boogeyman, aside from all the usual bad stuff that’s lurking: China trade, impeachment, the election, etc.) is the bond market. If bond yields move decidedly above 2% on the U.S. 10-year note, and the bond traders holding negative yielding debt panic, the odds of the market’s rally continuing will diminish. Thus, the day of reckoning is out there, just not likely for a few more weeks, barring the development of a nasty surprise which pushes bond yields decidedly higher in a hurry.

I own C as of this writing.

Joe Duarte has been an active trader and widely recognized stock market analyst since 1987. He is author of Trading Options for Dummies, and The Everything Guide to Investing in your 20s & 30s at Amazon. To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit here.