Despite his protestations against the rising dollar, President Trump approval ratings appear to be correlated to a rising dollar, writes Matt Weller.

In a classic “best house in a bad global neighborhood” trade, the U.S. Dollar Index is off to its best start to a year since 2015, rising against each of its major rivals year-to-date.

While relatively strong economic data and safe-haven demand amidst the Coronavirus outbreak have certainly played a role in boosting the dollar, an underappreciated driver may be the prospects for President Trump to get reelected.

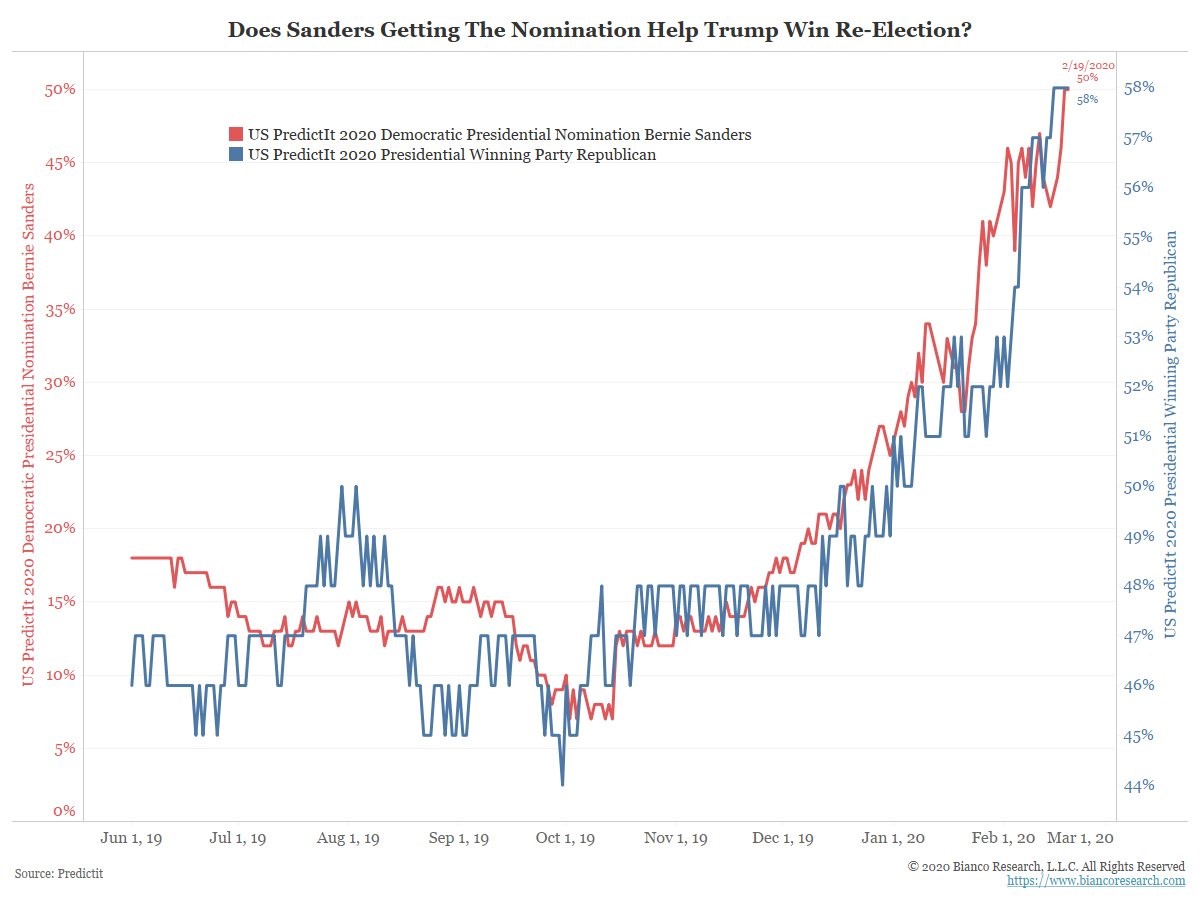

As the U.S. economy remains on solid footing and the impeachment inquiry fades, President Trump’s approval rating is hitting its highest mark since the first month of his presidency. Though he still lags behind nearly every modern U.S. president on this measure, the trend is certainly heading in the right direction for the “Keep American Great” crowd. At the same time, possible rival and self-proclaimed “Democratic Socialist” Bernie Sanders is piling up delegates and looking increasingly likely to be the Democratic nominee, a development that political analysts believe bodes well for Trump’s reelection odds (see chart).

Source: Predictit, Bianco Research

When it comes to the greenback, President Trump continues to publicly condemn the strength in the US dollar and advocated for interest rate cuts from the Federal Reserve, but dollar bulls don’t seem to mind.

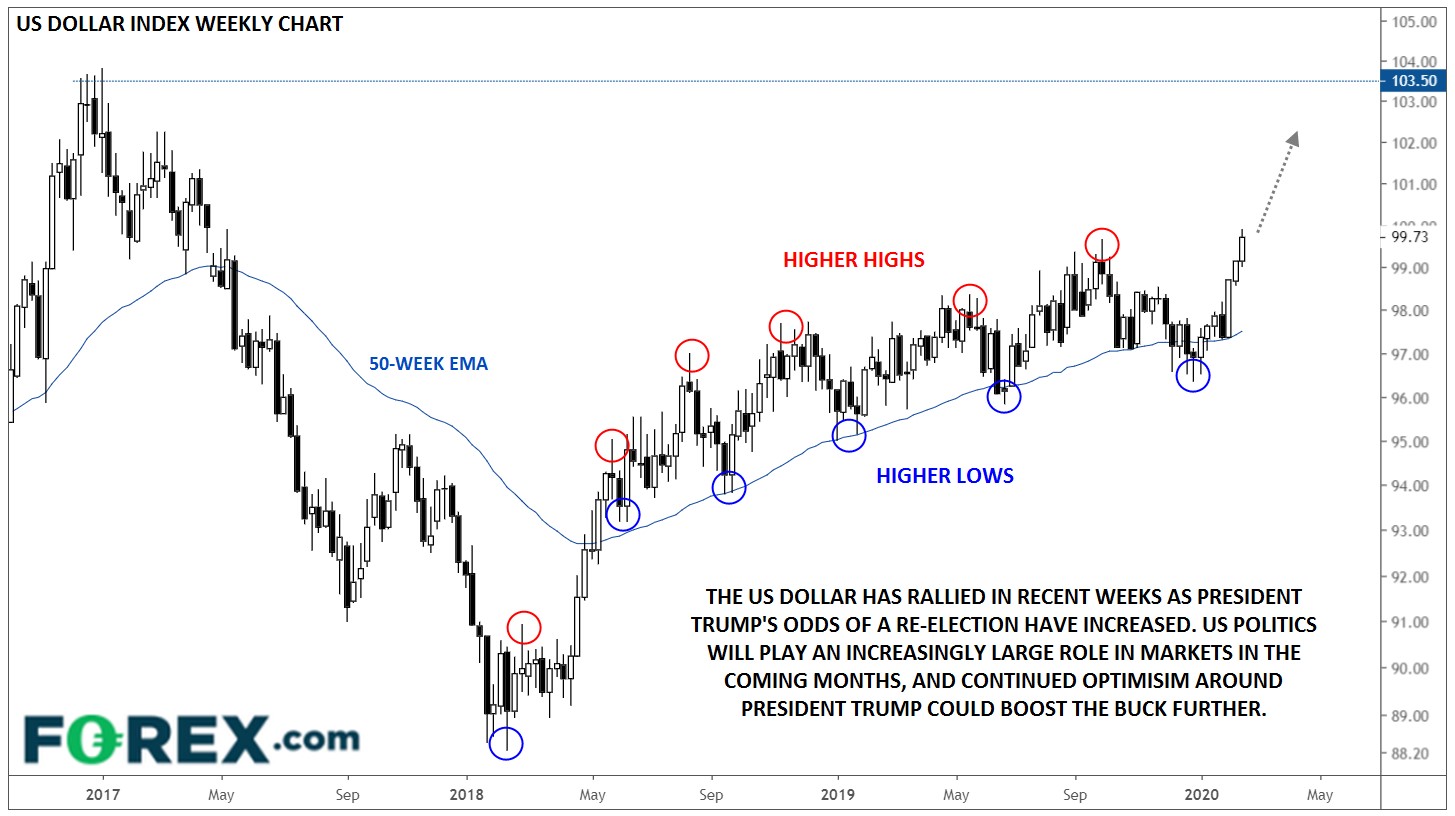

In recent weeks, the administration has floated a potential middle-class tax cut and large infrastructure package. Developments like these and the Trump Administration’s general business-friendly policies have helped boost the value of U.S. stocks and make the U.S. dollar more attractive to global wealth managers in general. As a result, President Trump’s approval rating has shown a 70% correlation with the value of the U.S. Dollar Index over the course of his presidency, according to research by TD Securities (see chart below).

As we move toward the ides of March and the general U.S. public starts to tune in, political headlines will increasingly suck the proverbial air out of the room. If those headlines increasingly point to President Trump winning reelection, the U.S. dollar could build on its recent gains, with the widely-watched U.S. Dollar Index potentially breaking back above 100.00 and perhaps challenging 2017’s 17-year high near 103.50 (see chart).

Source: TradingView, GAIN Capital

Traders have always been a forward-looking bunch, and with a little more than eight months to go until the U.S. Presidential election, the evidence suggests that they believe another four years of President Trump could be good for the dollar.

Don’t forget that you can now follow Forex.com’s research team on Twitter: twitter.com/FOREXcom and you can find more of FOREX.com’s research here.