Covered-call writing is associated with two legs: we are long the stock and short the call option, explains Alan Ellman of The Blue Collar Investor.

If we add a protective put, we have converted the covered-call trade to a collar trade, which has both a floor (put strike) and a ceiling (call strike). The traditional collar trades uses out-of-the-money strikes for both option positions. This article will simplify the process for determining which are the most appropriate strike prices to choose.

Setting Our Initial Time-Value Return Goal Range for Collar Trades

Since we are incurring a debit when we buy the protective put, we must select a lower range than we would for traditional covered-call writing. The higher the returns, the greater the risk so we must find a range that aligns with our personal risk tolerance. This will vary from investor to investor. For me, it’s 2%-4% and up to 6% in bull markets for one-month near-the-money call options. For collars, we would adjust that range depending on how much protection we are seeking. A reasonable range for collars for those seeking returns similar to mine would be 1%-2% per month and up to 3% in bull markets (in strong bull markets, we may opt not to buy protective puts).

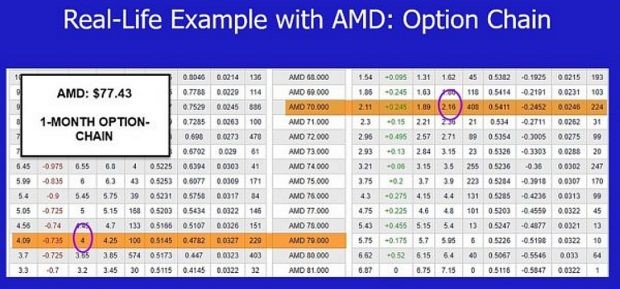

AMD Option-Chain for Calls and Puts

- The $79.00 call generated $4.00 per-share

- The $70.00 put costs $1.84 per-share

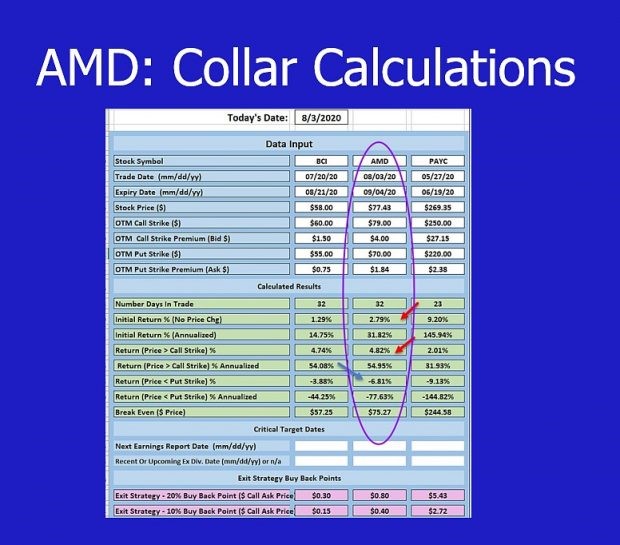

Collar Calculations with the BCI Collar Calculator

AMD Calculations: The BCI Collar Calculator

Initial time-value results

- The net one-month time-value return is 2.79%

- Maximum one-month return with upside potential is 4.82%

- The maximum one-month loss is 6.81%

Discussion

Collar strikes are generally out-of-the-money. We first set the initial time-value return goal range that fits our personal risk tolerance profile for the call premium and then halve that amount to buy the protective put. The option chain will guide us to those appropriate strike selections.

Learn more about Alan Ellman on the Blue Collar Investor Website.