Real estate investment trusts (REITs) have seen a spike in popularity in 2017. REITs typically purchase office buildings, hotels and other properties to produce income, notes ETF expert Jim Woods, editor of Successful Investing.

The Vanguard REIT ETF (VNQ) is a hassle-free play on the U.S. real estate space with a large, well-known investment group. REITs offer many attractive advantages versus other types of investment vehicles including:

1. High yield – The longer-term average for REITs has been trending in the 7-8% range, well above the yield of the S&P 500 index.

2. Liquidity – REIT shares are bought and sold on a stock exchange, which is a far more efficient and easier market than buying and selling properties directly.

3. Diversification – REITs offer a good way for investors to spread their risk.

4. Simpler tax treatments – distributions from VNQ and other peer ETFs are taxed as ordinary income.

VNQ has $35.33 billion in assets and an expense ratio of just 0.12%. The fund holds a deep basket of 152 companies in its portfolio that covers almost all kinds of real estate. VNQ boasts a huge average daily trading volume of $287.12 million and a very low spread of 0.01%.

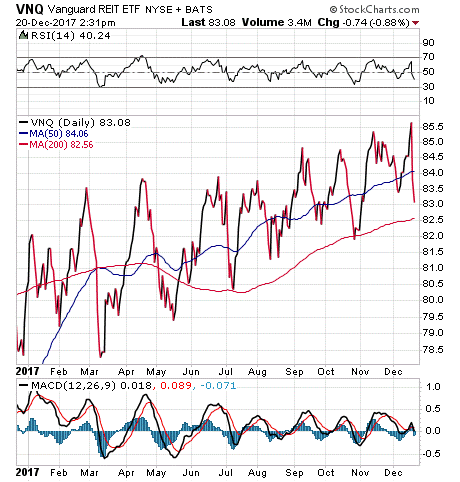

Yield-seeking investors sometimes compare the yields of REITs to bonds. While it is true that bonds offer similar income at a generally lower risk, REITs have a much higher potential for growth. As a result, VNQ’s share prices tend to rise and fall more sharply than funds that hold bonds, which is evident in the chart below.

The REIT’s top five holdings are: Simon Property Group (SPG), 5.23%; Equinix (EQIX), 3.76%; Prologis (PLD), 3.66%; Public Storage (PSA), 3.47%; and AvalonBay Communities (AVB), 2.60%.

Year to date, VNQ has returned 6.90%, compared to a 20.07% year-to-date return of the S&P 500. VNQ has a dividend yield of 4.8%. If you are seeking a way to get into the REIT space, consider Vanguard REIT ETF as a potential investment.