Our Tactical Trends Portfolio holds what I call the “best-of-breed” stocks and/or sectors moving the market right now, explains Jim Woods, growth stock expert and editor of Intelligence Report.

These will be the stocks and/or sector funds that are outpacing their peers, not just in terms of share-price performance, but also in terms of the most important of fundamental metrics (earnings growth and revenue growth). Here are two new buys I’m recommending for your short-to-medium-term trading portfolio.

UnitedHealth Group (UNH)

The health insurance giant is fresh off a great Q4 earnings report that easily bested expectations on the top and bottom lines. The stock is also slated to benefit from government gridlock.

With Democrats in control of the House of Representatives, there will likely be no changes to the current health care laws, which is a big benefit for UnitedHealth.

Shares of UNH have spiked some 6.5% in just the past week to bring this stock back above its 50-day moving average. That means now is the time to add this stock to a shorter-term, tactical portfolio. Buy UNH, at market, and set a stop loss at $224.40 (approximately 15% below the current share price).

Edwards Life Sciences (EW)

The medical devices maker is a leading manufacturer of devices for advanced stages of heart disease. Its key products include surgical tissue heart valves, transcatheter valve technologies, surgical clips, catheters and retractors and monitoring systems used to measure a patient’s heart function during surgery.

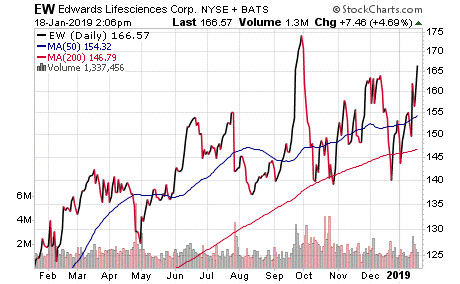

EW shares have been on a tear of late, up over 8% this week. The anticipation here is for strong earnings, as the company is expected to report on Jan. 31. Like UNH, EW shares are strong both fundamentally and technically, as the stock also just recently broke above the 50-day moving average.

I suspect much more upside from this earnings powerhouse in the coming quarters, and that means now is a great time to add EW. Buy EW, at market, and set a stop loss at $141.53 (approximately 15% below the current share price).