The Utilities Select Sector SPDR Fund (XLU) is an exchange-traded fund intended to give shareholders access to the utilities segment of the economy, observes ETF expert Jim Woods, editor of The Deep Woods.

Specifically, XLU tracks the Utilities Select Sector Index, which, in turn, attempts to mirror the performance of the utilities sector of the S&P 500 Index. The decision of XLU’s management to invest only in utility companies that are in the S&P 500 has allowed this ETF to amass huge assets and volume.

At the same time, the portfolio is heavily concentrated in a few large firms. Among them are NextEra Energy (NEE), Duke Energy (DUK), Dominion Energy (D), Southern Company (SO), Exelon (EXC), American Electric Power Company (AEP), Sempra Energy (SRE), Xcel Energy (NXEL) and WEC Energy Group (WEC).

The fund currently has more than $10.89 billion in assets under management and an average spread of 0.02%. It also has an expense ratio of 0.13%, meaning that it is less expensive to hold than some other ETFs.

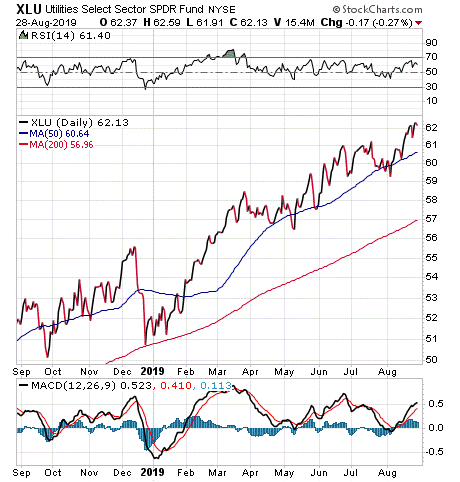

This fund’s performance has been generally positive in both the short and long run. As of Aug. 27, 2019, XLU gained 3.87% over the past month, rose 4.96% over the past three months and soared 19.54% year to date.

Of course, while XLU does provide an investor with the chance to profit from the world of utilities, the sector may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.