According to Black Knight, a mortgage data company, the number of Americans past due on their mortgage jumped by 1.6 million in April, a whopping 90% increase from March, cautions Tony Sagami, editor of Weiss Ratings' Ultimate Portfolio.

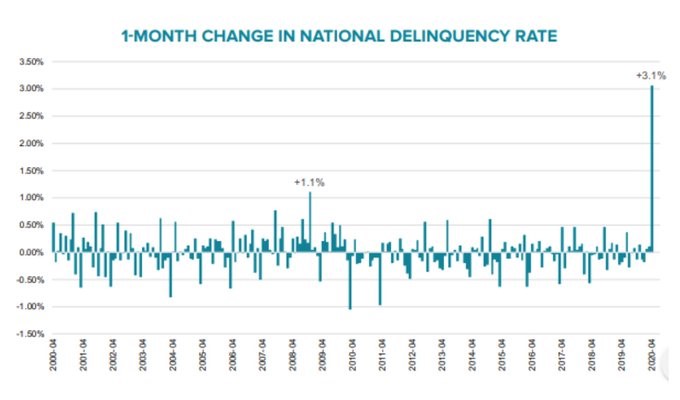

The mortgage delinquency rate has jumped to 6.45%, more than double the 3.06% in March. That is the largest single-month jump in history and nearly three times the peak of the 2008-09 Financial Crisis:

Consider this perspective: It took 18 months during the Great Recession before the first 1.6 million homeowners became delinquent on their mortgage. Today, a total of 3.6 million Americans are already behind on their mortgage payments.

Of course, the coronavirus pandemic is behind the surge in delinquencies, but thanks to the Coronavirus Aid, Relief and Economic Security Act, homeowners can suspend mortgage — aka forbearance — payments for up to a year on federally backed mortgages.

8.8% of mortgages are currently in forbearance mode and that number is growing by the day. Black Knight said that mortgage lenders are getting about 27,000 new forbearance request every day!

After the coronavirus unemployment benefits run out next month, I expect to see a second wave of delinquencies.

And that’s bad news not only for unemployed homeowners who could lose their homes, but also for the entire real estate sector. After all, foreclosures can drag real estate prices lower. Perhaps a lot lower.

We all need a place to live, so we can’t just sell our houses ... even if we are convinced that home prices were headed lower.

If you really believe that real estate prices are headed lower and are willing to take some risk, you might consider these three ETFs that are designed from falling real estate prices:

ProShares Short Dow Jones U.S. Real Estate Index ETF (REK) is designed to move in the inverse direction of the Dow Jones U.S. Real Estate Index.

ProShares Ultrashort Dow Jones U.S. Real Estate Index (SRS) is just like REK, but will move twice (200%) the inverse direction of the Dow Jones U.S. Real Estate Index. This ETF offers double the opportunity ... but with that comes double the risk if the markets move against you.

Direxion Daily MSCI Real Estate Bear 3X ETF (DRV) is designed to move three times (300%) the inverse direction of the MSCI US IMI Real Estate 25/50 Index (a REIT index).