Industries, and occasionally entire sectors, go in and out of favor. Right now, the regional banking sector is out of favor. But many regional banks have proven they can grow their dividend through difficult times for financials. One example is Cambridge Bancorp (CATC) with 24 consecutive years of dividend increases, highlights Ben Reynolds, editor of Sure Dividend.

The S&P Regional Banking ETF (KRE) is down ~50% from its all-time high price of $78.81 reached in January of 2022. It is trading around where it did for much of March through September of 2020, during the height of COVID-19 fears.

Banking industry sentiment is strikingly negative thanks to high profile failures at Silicon Valley Bank, Signature Bank, and First Republic Bank. There are certainly good reasons to be fearful of regional banks. Banking is a confidence game. The more confidence is lost, the faster deposits go out, in a negative feedback loop.

Additionally, higher interest rates for short-term treasuries and money market funds make low yield checking and savings accounts a comparatively poor place to park idle funds. Why take the credit risk at a bank for less yield?

On the other hand, while the current banking situation is not favorable, I don’t believe it to be near as dire as the Great Financial Crisis in 2009. And many regional banks not only survived this difficult period, they increased their dividends through it.

CATC is a bank holding company that operates the Cambridge Trust Company. Through this subsidiary, Cambridge Bancorp offers a range of banking and related products in the northeastern U.S. Cambridge has a network of 25 offices in Massachusetts and New Hampshire.

The company was founded in 1890, generates about $165 million in revenue, and trades with a $407 million market cap. Cambridge posted first-quarter earnings on April 25th and results were quite strong. The bank posted net income of $12.4 million, which was up almost 10% year-over-year. On a per-share basis, earnings came to $1.58, which was up from $1.44 in the year-ago period.

Net interest and dividend income before credit loss provisions fell $6.6 million, or 16%, to $34 million. This decline was due primarily to a higher cost of funds, partially offset by an increase in the bank’s average earning assets, and higher loan yields. Net interest margin was down 45 basis points to 2.63%.

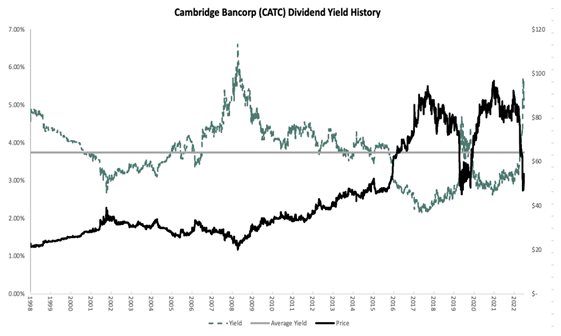

We see the share price as attractive despite the recent advance in the stock price, and a corresponding 8.8% tailwind from the valuation. In total, we expect 18.7% total returns, primarily driven by the valuation, but aided by 6% growth and the 5.3% yield.

Recommended Action: Buy CATC