I’ve been watching SentinelOne Inc. (S) for a while now, and as we start 2025, I see this AI-driven cybersecurity standout coming into its own. I started picking up shares back in May 2024, and I think patient, long-term investors who stick around are going to be rewarded down the line, suggests Jerry Robinson, founder of Followthemoney.

This firm brings a unique combination: Cutting-edge tech, rapid scaling, and a price tag that still feels pretty decent when you consider its growth curve. I like that this cybersecurity firm is leveraging next-gen, AI-powered endpoint security to sniff out threats in real time and respond instantly. In a world where cyberattacks are evolving at breakneck speed, adaptability is a necessity, not simply a feature.

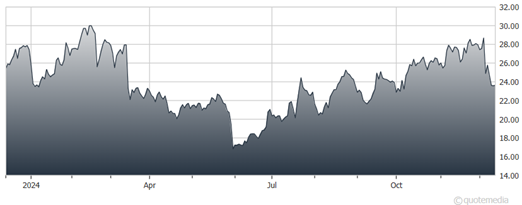

SentinelOne Inc. (S)

I’m especially bullish on SentinelOne because it’s on track to hit positive EBITDA and cash flow in 2025, which is much faster than the timelines we saw from some of its heavyweight competitors like Palo Alto Networks Inc. (PANW) or CrowdStrike Holdings Inc. (CRWD). That’s no small feat and tells me this management team, led by CEO Tomer Weingarten, has their heads on straight when it comes to growth and execution.

With its AI-driven engine under the hood, constant (but smart) platform refinements, and the tailwind of more devices, more data, and more complex threats, SentinelOne looks ready to grab more market share and command attention from investors in the coming year. I see plenty of upside ahead for patient, long-term investors.