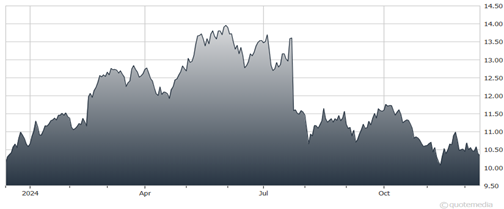

My income-focused pick for 2025 is Bermuda-based shipping giant SFL Corp. (SFL). Interestingly, this was also my top income idea back in 2022 when the shares were trading at just over $8. The pick performed exceptionally well, delivering a total return of 24.4% that year through dividends and capital gains, writes Nikolaos Sismanis, analyst at Sure Retirement.

Despite declines in its share price in recent months, SFL remains well-positioned, with strong prospects to generate substantial income. That makes it an equally attractive pick today.

For context, the broader shipping markets have faced challenges recently, with dry bulk rates softening from pandemic-era highs, tanker markets experiencing bouts of oversupply, and containership demand facing pressures from a global slowdown in trade. These conditions have introduced heightened volatility across the maritime sector, leaving many shipping companies struggling to stabilize revenues.

SFL Corp. (SFL)

What sets SFL apart, however, is its ability to shield itself from this volatility through its strategic focus on long-term contracts. With a weighted average charter term of 6.7 years and a fixed-rate charter backlog of $4.7 billion, the company has effectively locked in predictable cash flows for years to come.

These contracts not only provide SFL with stability against industry headwinds, but also ensure that its financial results remain resilient regardless of short-term market fluctuations. This characteristic makes SFL a standout investment in an otherwise cyclical and unpredictable industry.

Of course, the cornerstone of SFL's appeal is its attractive dividend yield, recently sitting at 10.4%. While many peers have struggled to sustain payouts during downturns, SFL has consistently raised its dividend in recent years, highlighting management's commitment to shareholder returns.

I believe the company's current payout level remains well-covered by earnings, supported by its contracted cash flows, and is unlikely to face pressure in the foreseeable future. For income-oriented investors, this reliability is a rare find in the shipping sector.

It's also worth noting that, besides the multi-year contracts helping the company against the shipping industry's cyclical nature, SFL also benefits from a well-diversified fleet. It spans crude oil and product tankers, dry bulk carriers, containerships, car carriers, and offshore drilling units.

For these reasons, I view SFL as an appealing income option, with the recent weakness in its share price forming a compelling buying opportunity.