Natural gas is by far the cleanest burning fossil fuel. It is also by far the fastest growing fossil fuel. That’s why I recommend Williams Companies Inc. (WMB), a firm involved in the transmission, gathering, processing, and storage of natural gas, says Tom Hutchinson, editor of Cabot Dividend Investor.

Clean energy is not yet cheap or reliable enough with the necessary infrastructure to replace the abundant and cheaper fossil fuel sources – and it probably won’t be for a long time. Even some of the staunchest alternative energy advocates increasingly see natural gas as a necessary transition to a clean energy future and a crucial grid stabilizer.

Demand across the globe is booming and continues to increase. At the same time, the US is the world’s largest producer of natural gas and the largest exporter. Natural gas use was already growing. The addition of soaring electricity demand and exploding US exports will continue to spike demand even more.

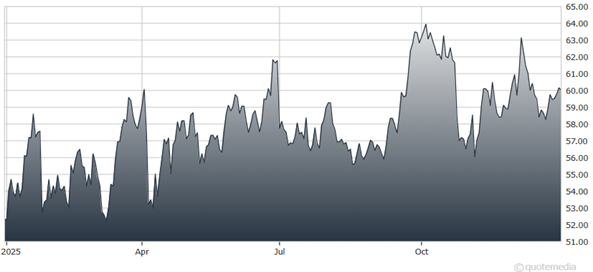

Williams Cos. (WMB)

Williams operates the large Transco and Northwest pipeline systems that transport gas to densely populated areas from the Gulf to the East Coast. Roughly 30% of the natural gas in the US moves through Williams’ systems.

Midstream energy companies are not reliant on prices, but rather charge a fee for the storage, processing, and transport of oil and gas. These companies benefit from volumes and should benefit as more oil and gas sloshes around the country.

The overwhelming bulk of earnings are guaranteed by long-term contracts, too. And those contracts have automatic inflation adjustments built in. WMB also operates a near monopoly in its operating areas – so it doesn’t have to compete on price with other similar companies.

Williams currently pays a dividend of $2 per share annually, which translated to a solid 3.2% yield at the recent price. WMB has also increased the payout for the last nine consecutive years.

Recommended Action: Buy WMB.