Given all the progress the company made in 2025, I am extremely comfortable making MannKind Corp. (MNKD) my Top Pick again for the coming year. Its lead product is Afrezza, an inhalable form of insulin for both Type 1 and Type 2 diabetics, highlights Nate Pile, editor of Nate’s Notes.

While the slow rate of adoption of this game-changing way to manage blood sugar has been frustrating for many shareholders to live through, there is good news. Not only is the product slowly but surely making inroads against traditional ways to administer insulin, but the company has filed with the FDA to officially expand the label to include pediatric patients – along with the adult population it is already approved for.

To be sure, there are never any guarantees when it comes to how the FDA will rule on such things. But I believe the odds are good that the product will be approved for this important segment of the market sometime in the second quarter of 2026. Though only time will tell how the new label will change the landscape, common sense suggests that there is plenty of room for the product to surprise on the upside once doctors and parents alike are made aware of the option for their newly diagnosed patients/children.

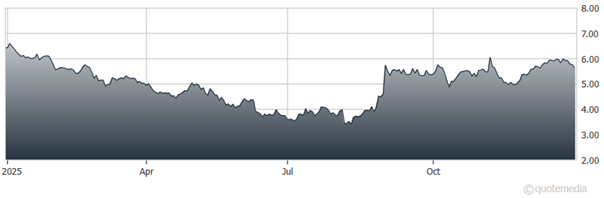

MannKind Corp. (MNKD)

Along with manufacturing and marketing Afrezza on its own, MannKind also produces a form of inhalable treprostinil called Tyvaso DPI for its partner, United Therapeutics Corp. (UTHR). United not only pays MannKind to manufacture the product, but also shares 10% of all sales of the product with MannKind.

I am also very pleased to report that MannKind recently acquired another small company. It has submitted a Supplement New Drug Application (sNDA) to the FDA for approval of a rapid-acting furosemide auto-injector for treating edema in heart/kidney disease. It will cut the time required to administer the drug from several hours to roughly 10 seconds – and analysts are optimistic that this product will help drive additional revenue growth for MannKind.

Biopharma stocks tend to be more volatile than stocks in most other sectors. So, investors are encouraged to build positions by making several small purchases over an extended period of time rather than with a single large purchase all at once. But I believe the risk-reward ratio on this stock is more attractive than it is for many others.

Recommended Action: Buy MNKD.