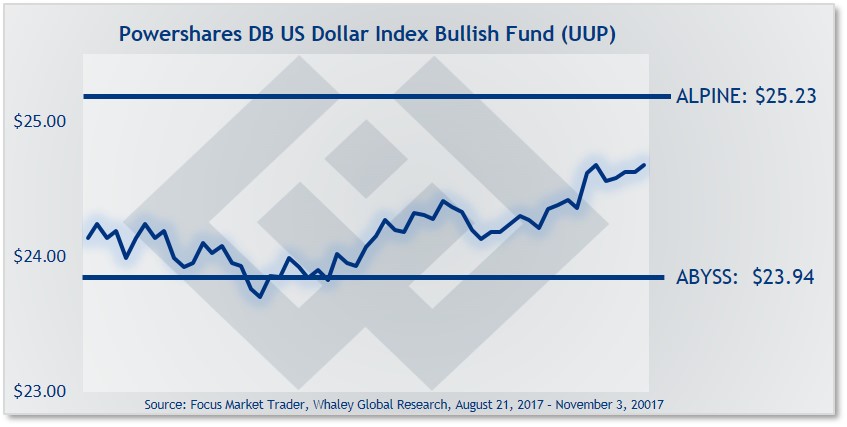

As long as UUP trades above $23.94, use any weakness, to $24.38 or lower, to initiate new long trades. Depending on where you enter the trade and how much room you want to give this trade, use a risk price between $24.11 and $23.94, suggests Landon Whaley of Focus Market Trader.

The Powershares DB US Dollar Index Bullish Fund (UUP) gained 4 basis points in the week ending November 3, but remains 6.7% underwater for the year.

Despite being the least anticipated Fed statement in recent years, it was still more critical than a tax reform proposal that is a long way from being law.

The Fed came out more positive on the economy by upgrading their words from “moderate” growth to growth “at a solid rate,” which at the margin is slightly more hawkish. The Fed stated, “near-term risks to the economic outlook appear roughly balanced,” while acknowledging that “Inflation on a 12-month basis is expected to remain somewhat below 2 percent in the near term but to stabilize."

They went on to say, “The committee expects that economic conditions will evolve in a manner that will warrant gradual increases in the federal funds rate."

Boy, that doesn’t leave a lot of wiggle room for folks expecting dovish Fed commentary.

Don’t get me wrong, my long U.S. dollar bias isn’t just about Janet Yellen having my back.

On the corporate front, 80% of companies have now reported earnings and once again, sales and earnings growth are accelerating. Based on the S&P 500 companies that have reported, sales growth is running at 5.9% and earnings growth accelerated to 8.0% on an annual basis. Nasdaq companies are growing sales at 11.6% and earnings at 22.4% annually.

On the macro front, October’s labor market data showed both ADP and non-farm payrolls growth accelerated higher, bouncing back after a mild slowdown due to the historic storms in September. The labor market continues to tighten and create jobs at a nice clip

The Fed is on aboard with a strong USD, corporate profits are accelerating, and the economy keeps on creating jobs. That is the perfect equation for a higher greenback.

Trade idea:

As long as UUP trades above $23.94, then you can use any weakness, to $24.38, or lower, to initiate new long trades.

Depending on where you enter the trade and how much room to move you want to give this trade, you can use a risk price between $24.11 and $23.94.

Your risk price line in the sand is $23.94, if UUP touches that price, even for a second, then you should exit any open trades.

If the trade moves in your favor, you can book profits on any rally to the $24.96 to $25.23 range.