Consider a bull put spread strategy for KO. In this two-legged options strategy, the trader sells to open a near-the-money put option, and simultaneously buys to open a lower-strike put, says Elizabeth Harrow, at Schaeffer's Investment Research.

Within the context of a 20%-plus rally in the broader Dow Jones Industrial Average (DJIA) year-to-date, the roughly 10% gain racked up by Coca-Cola (KO) in 2018 looks positively modest. But as the stock bounces from a key moving average, there's reason to believe that shares of the beverage giant are gearing up for another leg higher in the short term.

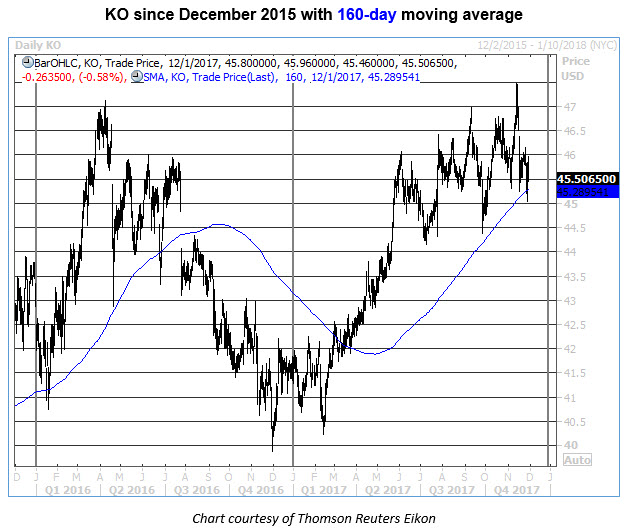

Specifically, KO is catching a lift from its 160-day moving average -- a somewhat “under the radar” trendline for many technical analysts, which makes buy and sell signals here that much more powerful.

Schaeffer's Senior Quantitative Analyst Rocky White looked back at previous occasions where KO has closed above its 160-day at least 60% of the time over the past two months and has traded north of this level in at least 8 of the past 10 trading days.

And on the seven previous occasions where KO has closed less than one standard deviation from its 160-day moving average, the stock has been higher 100% of the time five days later, yielding an average return of 2%. Looking out 21 days after a signal, KO boasts an average advance of 2.2%, with 83% of the returns positive.

Looking at these returns, the consistently positive nature of the post-signal returns is somewhat more compelling than the magnitude of the returns themselves. With that in mind, traders looking to capitalize on this technical signal may want to consider a bull put spread strategy. In this two-legged options strategy, the trader sells to open a near-the-money put option, and simultaneously buys to open a lower-strike put.

The initial credit received upon initiation represents the maximum profit on the play and will be attained as long as the underlying stock closes at or above the sold strike price upon expiration. In this best-case scenario, the trader needs to do nothing more than allow both options involved to expire worthless.

As such, the bull put spread is ideal for speculative players with a neutral-to-bullish outlook. So if you like the odds of KO moving higher from here, but aren’t looking to bet on major upside, this credit spread could be the right move for you. This is particularly true with 30-day at-the-money implied volatility on KO options arriving at a respectable 11.5% as of this writing, per Trade-Alert -- in the 55th annual percentile, and a decent jump from the 9.6% post-earnings low reached in early November.