LightPath Technologies reports a solid revenue gain despite the expected slowing in telecom. That U.S. and European telecom carriers are also rapidly seeing 5G as fertile ground is a plus for LightPath, writes Gene Inger in The Inger Letter Wednesday.

Wealth-effect lovers are livid at the prospects of our projected Trump advance of well over a year ago now, languishing and failing to rekindle their libido for higher stock prices. In that respect, the institutional stance seems to push aside monetary policy as if it was a fling that would not interfere with the relationship between an uptrend and lust for more.

In a sense, money managers (or algo-systems) really have avoided what might be called a pre-nuptual agreement for the investment arena. They have a lot invested in the relationship and can imagine a Fed or other mediator somehow defining what happens to assets if things change.

Real interest rates are going to go up if you get the kind of growth that’s needed and that’s the spousal interloper most are focused on. Ironically the Street tends to argue that investors should stay married to holdings basically permanently, even as the hedgers and others churn things in a faster manner, that almost any realize.

Furthermore, they borrow upon a future of perceived bliss, as if wanting to make the relationship persist, regardless of monetary policy or other considerations.

The Cialis market

And they’re doing this at an advance late-cycle phase by normal equity big-cap measures; although here I do believe that the prospects of this becoming the market version of a Silver Anniversary are enhanced if dynamic growth and initiative actually revitalize the market sufficiently.

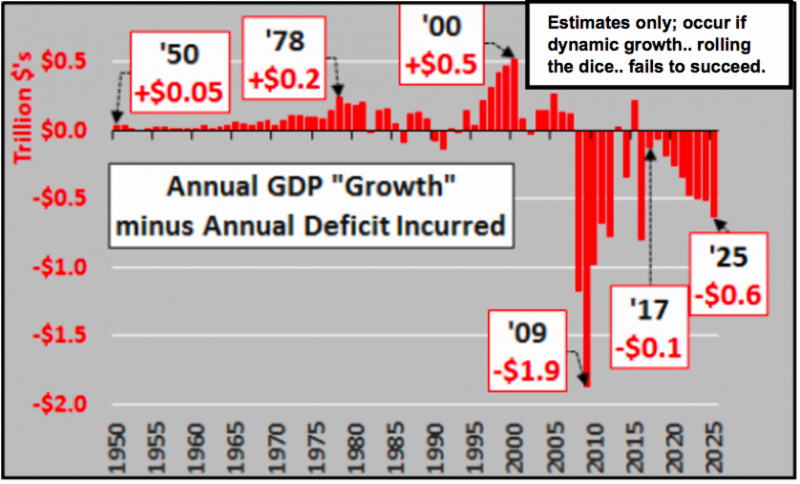

It is something that won’t be known for a while. But with the bloated debt (we all disdain in theory), at least there’s a chance to get a growth level actually kick-started (the seeds of that have already been implanted) to a degree that it revives the market’s libido; and hence a love-affair able to push equity prices ultimately to higher levels that are actually justified.

But at the moment this market is still nursing what needs to be sort of an evaluation of how the relationship (credit and equity) is going; seeking a sorting-out of underlying profitability prospects, as well as the technical aspect of stimulating the market. (Leverage and policies can become the Cialis of the market, ready to kick-in when the time is right.)

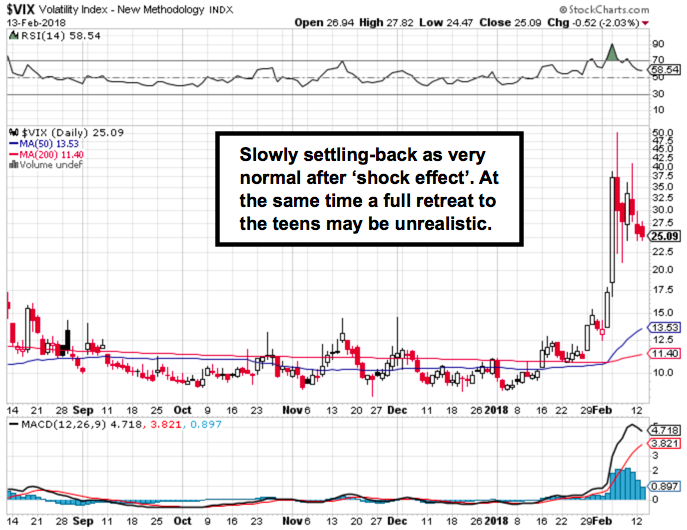

Around Valentine Day there’s fundamental confusion about the volatility relationships to valuation levels; whether the glue holding a relationship together is breaking (the Fed having dampened volatility for so long that complacency dominated management approaches.)

In sum: the seven year itch sort of hit the markets, as they now go through a phase of reconciling and reflex efforts to get together again, as part of a process of deciding where it wants to go next.

It’s not a coiled spring like you get with lust early in a romance, but it is a market looking at the fundamentals of a more mature relationship; that, of course, can keep the parties together, even if they have to reconcile a questionable affair or two, or merely a waning of the long-term libido.

In the end, the interests of staying together may prevail (the market’s not a young whippersnapper after all). But it was time for a rough spell and it is in mediation to determine whether the relationship flourishes anew.

Wednesday markets briefly notes a shakeout in the morning as rates firmed and a market that subsequently recovered but then went flat throughout the afternoon basically.

LightPath Technologies (LPTH) did report a solid revenue gain despite the expected slowing in telecom (not just ahead of Chinese New Year) but as nobody wants to invest in 4G with 5G right around the corner.

That U.S. and European telecom carriers are also rapidly seeing 5G as fertile ground is a plus for LightPath, making components in China for various vendors. By no means is that their primary focus going forward.

In fact, CEO James Gaynor made a point that Industrial segments should move to an even larger prominence, particularly as LIDAR and other systems (largely but not exclusively in automotive) come-into their own realm. As to the share price, it firmed a bit in aftermarket trading; no change in our vision of it appreciating as an investment over time.

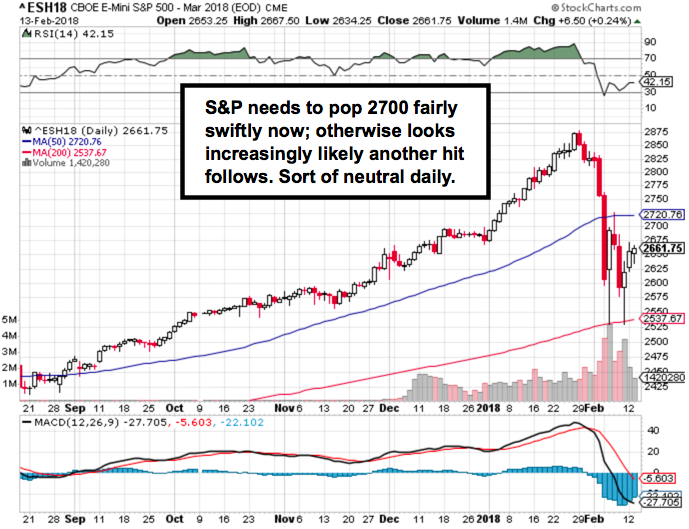

Short-term precision is impossible; not merely a challenge for traders seeking to catch rebounds; or fade those rallies. It goes on; but from this point, moves can be swift and shift, multiple times in a single session.

Sure, there were clues for a rebound by virtue of Friday's recovery that didn’t fade in the final minutes, but that was a perfect place to catch the market.

Then Monday saw follow-through that was lightly contested with the stable mid-session activity, with almost what seemed a determined effort to ignore the credit markets and just run-in shorts or drag-in funds with several institutions suggesting investment ideas.

Last week’s hints that many were waiting to sell the rebound suddenly seemed to vanish. Of course. it can be argued that if the correction is more than a blip (it was historic in points not percentages), then you shouldn't see investors just made whole again in the wink of an eye. And perhaps you won't.

Bottom line: the market’s tone clearly took indexes back from the brink and beyond; but leave it (perhaps at best) in a high-level range.

The prospect of a reciprocal tax (protectionism) announced later was generally ignored after the president mentioned it in comments about infrastructure; and may not be ignored later on (many probably feel it’s just jockeying and not a serious competitive defense for American industry).

Time will tell. Point is: markets remain high.