An upward consolidation session typically ensues a post-break S&P 500 (SPX) washout and on the surface Wednesday's dramatic turnaround was not an exception, writes Gene Inger.

It’s more interesting as we visited S&P’s 200-day moving average during the morning’s second wave of downside follow-through. No surprise as that’s very similar to what's occurred every time.

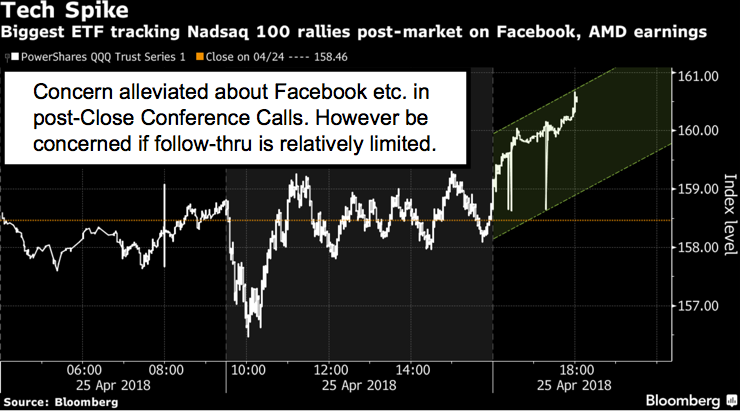

Bloomberg: Tech rally boosts stocks on earnings Thursday. Bonds rise.

Yes, we knew Tuesday night that the market might well do that and then get a reprieve. Again, it’s not simply intraweek bouncing efforts, but rather a sequel to what we've seen before. Hail Mary rebound tries as outlined for this session as likely. The rebounds were interim and not sustainable so far this year.

And in my view, it’s all part of trying to preserve what the majority want to believe is an intact cyclical bull.

Now, auctions were sloppy this week which shows a lack of aggressive buying or even some buying of Treasuries that are double-shorted. (That is a dangerous tactic that we’ll not delve into.)

But you do have another ECB meeting Thursday. By the opening in New York, we'll see if the 29-year wide spread between 10-year notes and German Bunds is just a bit telling of perhaps a snugging-up coming from the ECB that really wants to stay more than competitive.

Draghi insists outlook is solid as ECB skirts QE debate again Thursday.

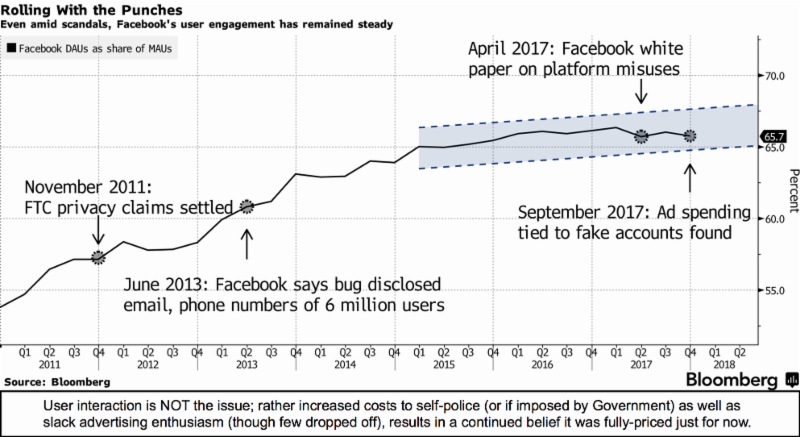

In sum: Rebounds were erratic. There was a confusing trading halt by the NYSE in Alphabet (GOOGL) and Amazon (AMZN), which didn't really impact shares as they trade primarily on NASDAQ, but didn't coincide with a shakeout but faded late in the day, then perked-up as earnings came out for Facebook (FB), Advanced Micro Devices (AMD), and a couple others but not eBay (EBAY). Most will rebounding further.

In my view, rebounds probably are based fundamentally on rising fears that rising rates overshadow a series of rising earnings (as they do).

In reality rebounds are primarily based on what I once again see as a technical risk of greater algorithmic selling likely to occur in the wake of a 200-day moving average penetration once we get that on a closing-price basis.