Summer usually brings a low volume market. Yet, when stock trading is mostly fueled by robot traders, low volume may mean just about anything. Furthermore, some traditions are worth considering, especially the adage – “never short a dull market,” writes Dr. Joe Duarte.

Did someone slip the stock market a Valium? If you look at stock charts and listen to market chatter in a vacuum, you may think that we are close to a market top, perhaps – as indicated by last week’s anemic trading volume - one induced by sheer boredom or perhaps a tranquilizer.

But if you look at the real economy it seems that things are quietly motoring along.

So, which one is correct? And which way will things break?

Although I am focused on the markets, it’s always useful to compare real life to the action seen on computer screen. Thus, I wanted to report on things I saw in the last few days on an early summer trip to south Texas.

First, the number of out of state cars from places such as Florida, California, Missouri, Illinois, Oklahoma and Louisiana was well above what I’ve seen before. In fact, this particular trend is something that I have seen rising steadily in Dallas over the last six months and which may be indicative of a once in a generational migration of the U.S population based on economic trends such as housing prices, job availability and political changes.

Second, popular car stops on I-45, such as the privately-owned Buc-EE’s gas station and convenience store chain were packed with customers who were spending money in a way I haven’t seen in the last few years. Due to the volume of traffic these stores see and their strategic locations amidst major routes in Texas, I’ve found these road stops useful as market and economic indicators in the past. Interestingly, I had to wait in line to enter the Madisonville store. And once inside the crowd was thicker than I’ve ever seen with money flowing to non-staple items such as t-shirts and souvenirs along with the usual drinks, snacks and other road foods.

Beyond Buc-EE’s, in Galveston, a place I have visited many times and have over the years developed a general baseline for assessment, I saw bigger middle-of-the-week crowds full of very relaxed people on the beach and healthy restaurant volumes at both mom and pop and chain establishments even during off hours. Cruise lines were doing a brisk business and street level parking near the shopping district was impossible to find.

Most notable was the fact that I didn’t overhear anyone complain about the state of the economy as I have experienced on visits to the same places in the past few years. Instead, I overheard people discussing their family issues and future business prospects. Furthermore, the road to Houston from Dallas was full of major construction projects with heavy truck and automobile traffic despite rising gasoline and fuel prices.

And for NAFTA doubters, I even saw several Canadian trucks heading to the Barnett Shale with oilfield supplies which suggests that negotiations on the treaty may work out after all.

I admit that this is all back of the napkin stuff. Moreover, a few days on the beach and a couple of visits to a few convenience stores is not a scientific study and that the top of any market is often lurking around the corner just when the general population is starting to feel positive about the future.

Nevertheless, I found this generally positive panorama in the real economy worth noting given the general feeling in the markets that we are near a major market top and that the Federal Reserve is about to destroy the economy by raising interest rates.

I also wondered whether the influx of out of state people into Texas indicates that the U.S. economy is about to enter a regional all or nothing scenario where the coastal and high tax states are about to crash and burn and states such as Texas will blossom, at least in the short term.

Summer pause ahead

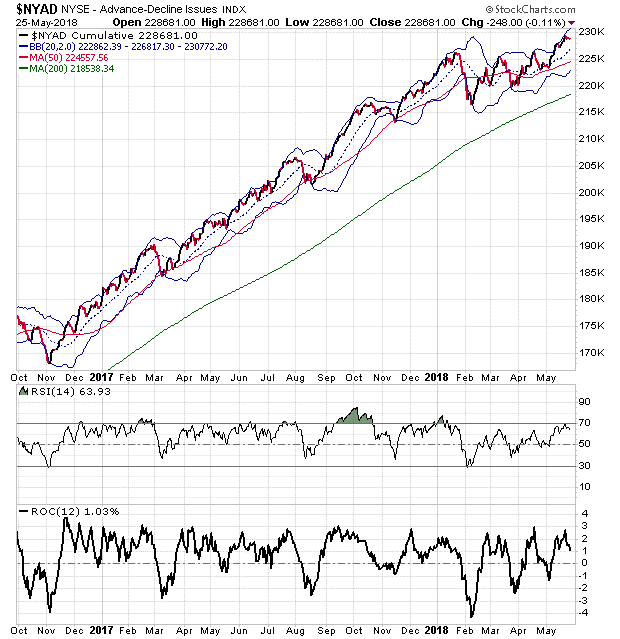

If the summer action in the New York Stock Exchange Advance Decline line (NYAD) last year is any guide to what’s coming in the next three months, investors can expect sideways action with a slight downward bias.

Indeed, the most accurate indicator of the market’s trend since the 2016 presidential election is tracing a similar pattern to what we saw around this time last year.

Note the general indecision in trading direction and the similar readings in the RSI and ROC indicators. Together these two metrics suggest a thinly traded market is what may lie ahead.

Indexes exude sleepiness

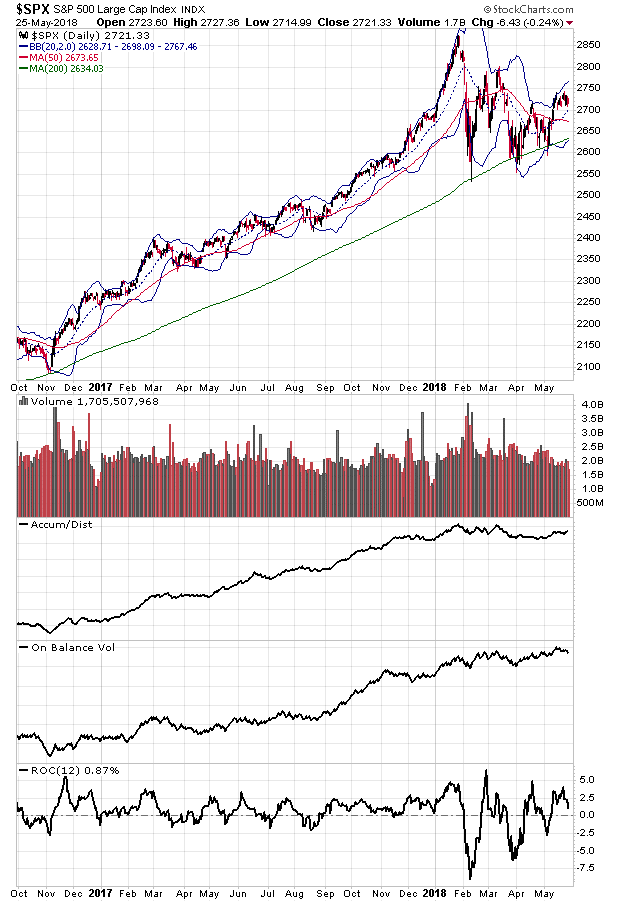

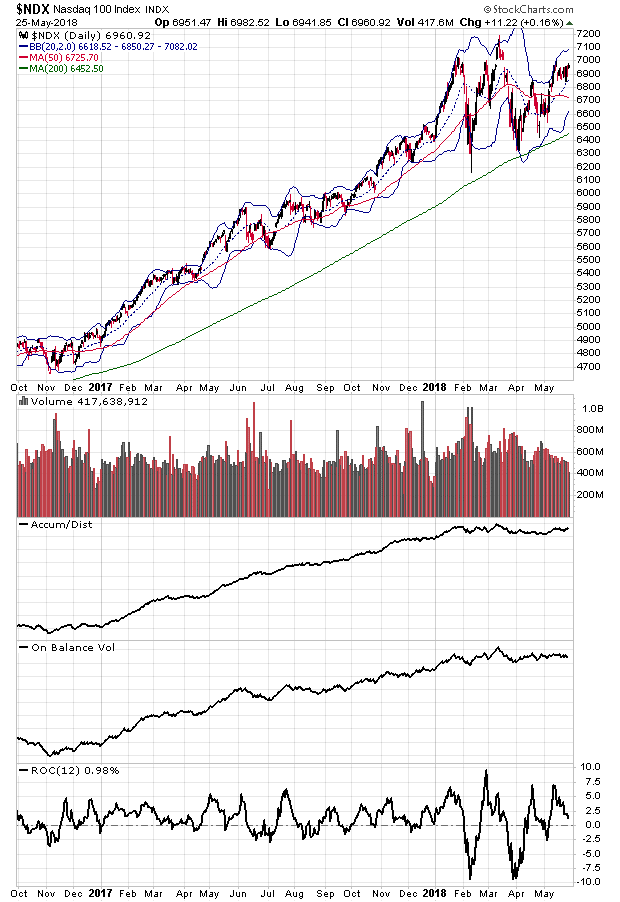

It may be that even robots take holidays, but last week’s volume was more indicative of the dullness in trading that often takes over Wall Street during the so-called Dog Days of August. Nevertheless, there were some interesting findings in the charts of both the S&P 500 (SPX) and the Nasdaq 100 (NDX) indexes.

Both the SPX and NDX charts share a lack of trading volume along with falling On Balance Volume (OBV) and Rate of Change (ROC).

Meanwhile, the Accumulation Distribution (ADI) line for both is rising. Together, these three indicators suggest that there are some buyers out there and very few sellers.

More buyers than sellers is always a good thing.

But with such low volume, and market breadth that may be ready to roll over it’s hard to know what’s next.

Never short a tranquilized market – even one run by machines

So, while we may smile at the thought of a robot slumbering in a Valium daze, it’s not a good idea to altogether turn your back on the market during dull periods because of headline risk and the fact that machines can come back online in a millisecond.

Furthermore, it seems as if we are now at that decision point where the economy is visibly and sustainably strengthening while the market is gauging whether growth is sustainable in the face of higher interest rates.

Joe Duarte is author of Trading Options for Dummies, now in its third edition. He writes about options and stocks at www.joeduarteinthemoneyoptions.com.