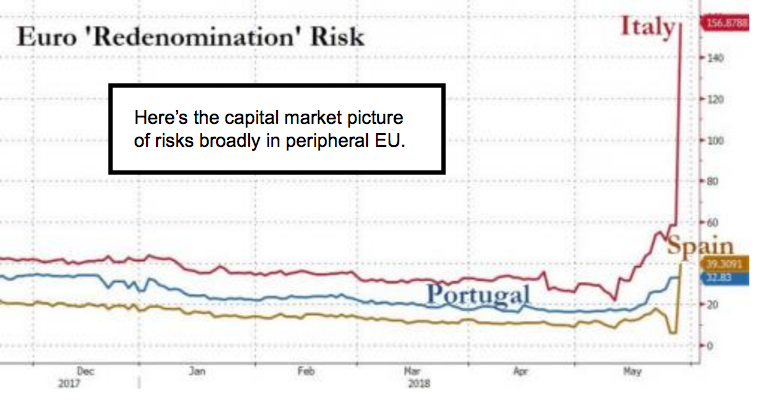

A power struggle among credit spreads in Europe is largely behind Tuesday’s reversal of the strong futures (overnight) based on a suspected reassembling of the off-and-on Korean Summit. By Wednesday afternoon, energy stocks fueled the market back up, writes Gene Inger.

The Italian financial patient harkens back to the financial concerns back in 2011-12. I assessed all the peripheral European suffering countries, particularly when I was in Spain both summers. What really hit the markets Tuesday was the sort-of-uncouth German finance minister with a Deutsche Welle comment that had Oettinger saying, “Markets will teach Italians not to vote for populists.”

Reuters: Wall Street rebounds Wednesday, fueled by energy stocks.

He later apologized (after European markets slid more near their trading day’s end). The damage was done. And it infected U.S. markets mostly because markets here were pricey, on tenterhooks as noted daily and of course looking for any excuse (existential or not) to break much lower.

Our view: Continued choppiness with a downward bias remains the prospect.

Europe is not really in a full-blown crisis again (although of course George Soros and others would like to proclaim that). All of this for sure drives the euro lower and the dollar higher.

But I’m one of the few so positive on the dollar for many months; though it’s entitled to rest here. I would say beware if it pushes all the way to par and then Goldman or a few others come out recommending it again.

US Treasury yields rise Wednesday as Italy worries ease for now: Reuters.

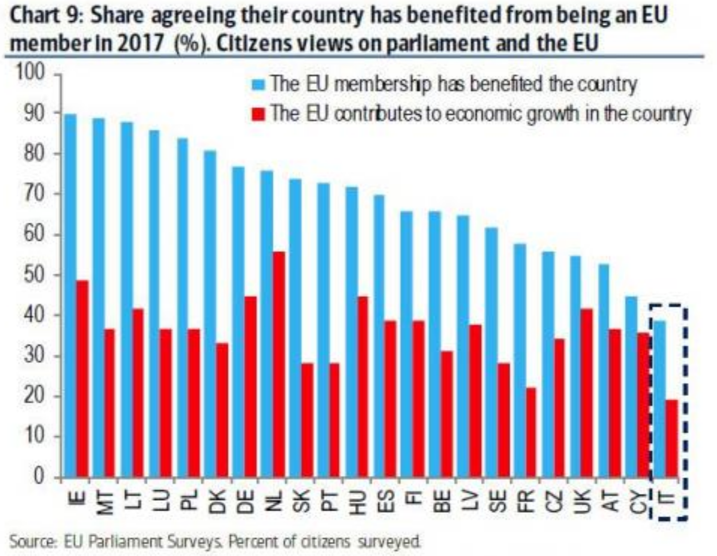

Now, Italy will not learn a new lesson too quickly; it’s gone thru 60 regimes in years and it’s not so much a referendum on the euro (EUR) or the EU itself. I say that because Soros and of course the Russians, want it to be just that, so are busy promulgating worst-case outcomes, rather than a brew-ha-ha.

That's not to say there’s not an issue, but it is to say Germany hyped it too much Tuesday. This brought back memories of how they mishandled Greek concerns (a much smaller economy) some years ago. Basically, it’s just excuses from our standpoint for a market that was on the verge of breaking just as we’ve indicated.

Technically the market S&P 500 (SPX) was not slapped in the face by bears as reported; but rather was slapped around every time it tried to rally last week, which I thought was the key (failure to make higher highs and repulsed every time).