Banks all over the world are rushing to change the way customers interact with financial services. Jack Henry is a trusted fintech in a world of attackers. The stock is a buy on further pullbacks, writes Jon Markman. He's presenting at MoneyShow Orlando Feb. 9.

Well, they want to make that happen. However, they’ve had a hard time finding expert partners and data security. But now, there’s a tiny financial technology startup from San Francisco called Plaid.

Plaid is patterning a path where innovation and digital infrastructure intersect. And it is creating an eye-catching profit opportunity for the banks, brokers, exchanges and money-transfer apps that were quick to see beauty in it.

Plaid makes software that offers a big step toward safer financial services transactions. Private investors now value the company at $2.65 billion.

It’s a big number, but the real story is about trusted connections.

|

While corporate boardrooms focused on software suites and apps to take their customers online, this Silicon Valley company was working diligently behind the scenes.

Plaid was building the connective tissue that turned smartphone screen taps and swipes into real-time account balances and money transfers.

Related post: How you tap, type & swipe can keep you safer online

In the process, Plaid’s application program interfaces became a trusted platform for developers.

Today, Plaid APIs seamlessly power apps that rely on fintech. Some names from that growing list include:

→ Venmo, the popular peer-to-peer payment system owned by PayPal (PYPL),

→ Cryptocurrency start-up Coinbase, which uses Plaid to link bank accounts to crypto trading accounts, and to flag fraud on its platform, and

→ Robinhood, a mobile investing — and, starting this week, banking — app that uses Plaid software tools to route money from customer accounts.

All in, company managers say its APIs integrate with 10,000 banks, representing 20 million consumer accounts.

The company inked a deal with JPMorgan (JPM) in October. According to a press release from the banker, the deal will give Plaid access to customers’ bank accounts through a secure API connection.

Here’s why that’s a big deal, for both investors and consumers …

Customers will be able to use the Plaid-supported mobile apps they love …while never giving up their password, usernames or other bits of private financial information.

Data security is a big deal. Trusted APIs, like those from Plaid, have become an important part of the financial technology ecosystem.

Big companies use them to silo proprietary code and data, while standardizing their processes. In the end, developers are able to build applications quicker, and more securely.

Private investors have known this for a long time …

Since 2013, Plaid has raised capital four times for a total of $309 million. Early investors are a who’s who of funding heavyweights. Goldman Sachs, Spark Capital, Box Group, Google Ventures and New Enterprise Associates have all participated in funding rounds.

The latest, and largest, round was led by Mary Meeker. This iconic internet analyst and partner at the venture capital firm Kleiner Perkins led early investments in Facebook (FB), Spotify (SPOT), Square (SQ) and Twitter (TWTR).

Meeker knows how to spot important trends. The emergence of new consumer-facing technology in the financial services sector is going to be one for the ages.

Culturally and geographically, Jack Henry & Associates (JKHY) is far removed from Meeker’s Silicon Valley. Yet the Monett, Mo., fintech company is hitting all the right notes with customers.

Managers built a thriving business serving 11,300 regional banks and credit unions. This company understands its customers are under attack from Silicon Valley start-ups.

As the lines blur between real-world and online banks, implementing the latest automation processes and value-added features for end users is more important than ever.

For many smaller, regional institutions, Jack Henry is the right expert partner.

Its software allows bank patrons to use their smartphones to move money between accounts, pay bills and deposit checks by snapping a photo. In the future, they will be able to perform many of these functions by voice.

Its Alexa skill brings voice-activated personal banking to Amazon Echo-enabled devices. These days, that could mean your living room or your car.

And all these services and applications are built on top of trusted APIs.

The success of Jack Henry is a testament to how quickly new technologies are sweeping through financial services, and the need for expert partners.

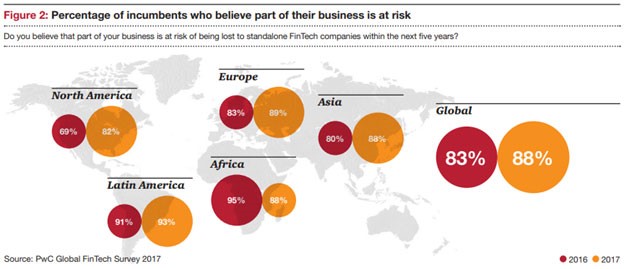

PricewaterhouseCoopers, the global accounting and consulting firm, found that a tidal wave of new investment in financial technology software is the offing. A 2017 report showed that 82% of incumbent financial institutions expected to increase partnerships with fintechs during the next three to five years.

Jack Henry revenues have been growing in the high-single-digits. Fiscal 2018 sales reached $1.54 billion. Profits accelerated to $376.7 million, up 52% over 2017 levels.

The shares are up 15% this year, and the market capitalization has reached $10.4 billion. After recent market weakness, the stock has settled back to 32.3x forward earnings.

Jack Henry is a trusted fintech in a world of attackers. The stock is a buy on further pullbacks.

Best wishes,

Jon D. Markman

Speaking of the trends that are transforming technology and, in turn, our world, my new book — “Fast-Forward Investing” — is listed as the No. 1 New Release in Business Finance on Amazon. I tell you all about how AI, self-driving cars, robotics and other technologies are reshaping our lives. Click here to check it out.

View these MoneyShow videos featuring Jon Markman.

Watch Jon Markman’s latest presentation: How to crush the post-IPO trade for emerging Tech companies here. My top 7 picks now.

Recorded: TradersExpo Las Vegas, Nov. 14, 2018.

Duration: 51:17

My sectors for a bear market: growth stocks, technology, healthcare.

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 3:34.

How to profit now from robotics, autonomous cars, AI and the cloud.

Recorded: MoneyShow Dallas, Oct. 5, 2018.

Duration: 37:31.

Jon Markman: Stock Picks in Industrial Tech, Video Games.

At MoneyShow Dallas, Jon Markman picks in industrial tech include Lockheed Martin and Northrop Grumman. And another part of tech: video gaming: Electronic Arts, Take-Two, Activision Blizzard.

Recorded: MoneyShow Dallas, Oct. 5, 2018.

Duration: 6:15.

Jon Markman: Self-driving cars offer surprise investing ideas.

At MoneyShow Dallas, Jon Markman shares tech stock ideas with Neil George of Profitable Investing. What's ahead in self-driving cars, a lot of spin-off positives for investors. A commuter cocktail?

Recorded: MoneyShow Dallas, Oct. 5, 2018.

Duration: 2:24.

Jon Markman's 5 tech stock picks, in a short video.

Picks: GOOG, AMZN, MSFT. Companies turning the hardware of the cloud into software: Arista Networks (ANET), Nutanix (NTNX).

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 5:13.

Jon Markman: S&P 3300, Tech, Healthcare Picks

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 3:33.

Jon Markman: What can end the Bull Market?

Recorded: MoneyShow San Francisco, August 24, 2018.

Duration: 1:58