Today was a softer finish, notable that a bump after 2 pm failed to catch and that leaves the near future indeterminate going into the weekend, writes Gene Inger Friday. He’s presenting at MoneyShow Orlando.

Thursday was an essential inside day. Consolidation was ideally what we wanted early on which was absolutely necessary to allow the full recovery of a couple of sharp downside swings. That set up the drama for more than recovery but a 900-point overall swing in the Dow by the time all was said and done. At minimum that allows a credible view toward Wednesday as a trading bottom just below S&P (SPX) 2350.

Reuters: Wall Street slips Friday but stocks mark a positive week.

**

Keep in mind where these markets are. It’s a reason I projected a seasonal, mostly pension fund-fueled rally. The so-called Santa Claus rallies occur after, not before observation of Christmas. And that’s due to the seasonal factors, mostly re-balancing.

**

Remember, 2300-2400 was the ideal S&P downside measure I suggested really for months, not just during the recent market pummeling.

**

So, Thursday’s S&P low was right at 2400. and that intraday trough occurred as rumors spread about huge on-close selling, which was a ruse. Why? In my opinion, because there was still enough pension fund re-balancing going on (although not so huge as Wednesday) that it could offset any selling on the bell, and it did.

**

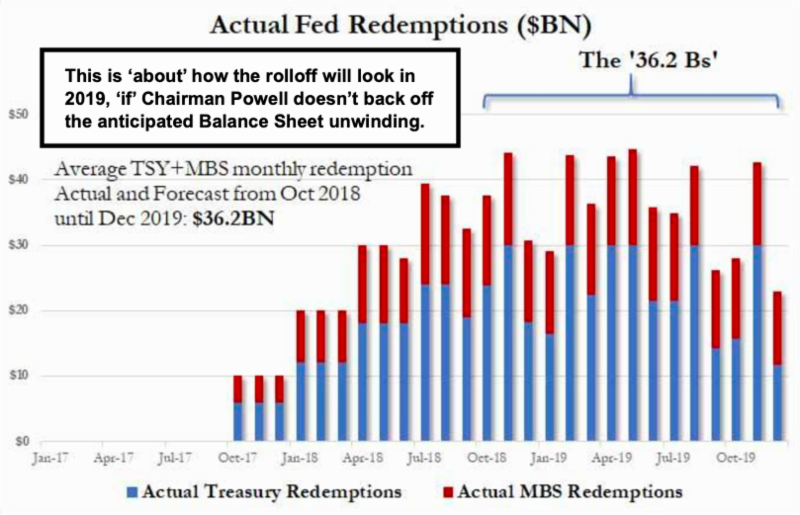

In-sum: I anticipated some year-end relief and we have that. However, by no means do we throw caution to the wind. And Fed policy adherence will mean a lot to the 2019 market. If they recant on balance sheet unwinding, it may be welcomed by Wall Street. It won’t be the right thing for a nation which finds itself trapped (almost regardless of fairly limited interest rates or policy swings) in a debt-service cycle that mitigates doing much else.

**

Rates a bit higher just make investors (and credit markets) aware of a rising cost of debt service, against the backdrop of enormous overall debt. And if I recall even the Pentagon described debt as a national security threat.

**

So yes, I expect this move to carry over into Friday and ideally slightly into a nervous start to 2019.

All-the-while keep in mind this move is still at higher levels than many think. Earnings and growth contraction for 2019 tends to suggest multiples have not really been compressed as some say. I am cognizant that a let’s be friends meeting between Chairman Powell and President Trump is likely coming. and the financial press will exude lots of enthusiasm for how that minimizes any hawkish prospects from the Fed. In fact, as the market holds up the Fed has less reason to back off of QT.