The market is swinging to-and-fro in this last hour Wednesday, but generally is giving back part of the earlier recovery we suspected would make it into positive territory, which it did before the new fading, says Gene Inger today. He’s presenting at MoneyShow Orlando.

Remember, this is a transition year for technology, plus ahead of the 2020 election tensions. That reinforces the idea that most significant problems for the market require sorting out in the year’s first half.

Perhaps oddly, from a market standpoint, getting an acceptable trade agreement with China is probably the most potentially favorable issue confronting markets. While the unknown characteristics of the political probe (inquisition?) the greatest odd unknown takeaway for markets down the line a bit. If there’s anything really capable of disruption past the first half, that might be on the agenda.

Reuters: Wall Street struggles for direction Wednesday in rocky start to 2019.

**

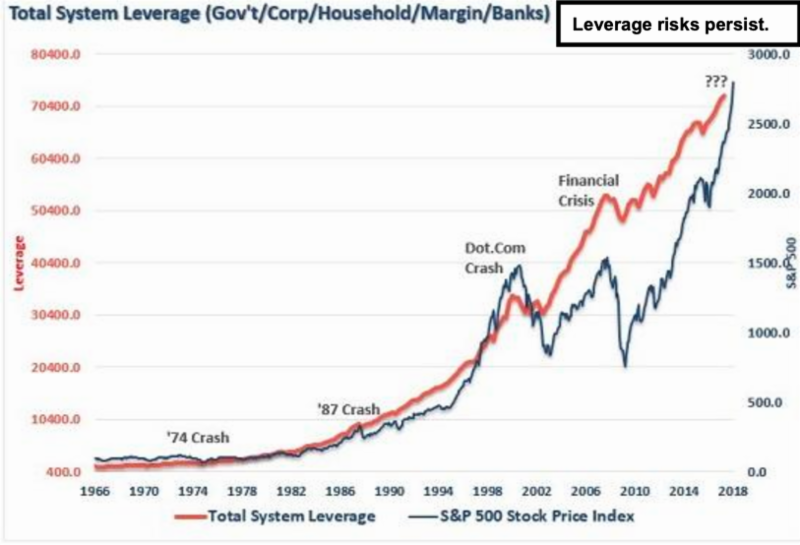

During 2018 bond traders began to see an increase in auction sizes after President Trump signed off on tax cuts. That surely heightened prospects of trillion-dollar deficits and a surge in bond supply in coming years.

Beyond of course the already-heavy roll-off calendar the Fed has to deal with. Maybe, just maybe, the Fed is grappling with this knowledge and thus absolutely is moving as they are, before that surge creates more bloated (dire?) scene.

Reuters: With global growth in question, 10-year yield hits 11-month low Wednesday.

**

So that’s probably why the classic equity/rate relationship got distorted plus the subsequent (more recent) rush to Treasuries for perceived safety. To put this in a summary form (remember I’m not a bond guy), consider that the Fed, nervous as heck about what’s coming, started to price a fiscal premium into U.S. Government long-rate bonds.

If so the historic correlation between stocks and bond yields may not just be temporary as Washington aims to give us trillion-dollar deficits for some time into the future. And frankly (aka Japan) things deter that when rates firm on their own beyond this incredibly bloated supply situation. That would really be exacerbated if they don’t roll-off the so-called automatic pilot 600 billion, as they planned but Wall Street and politicians are trying to dampen.

**

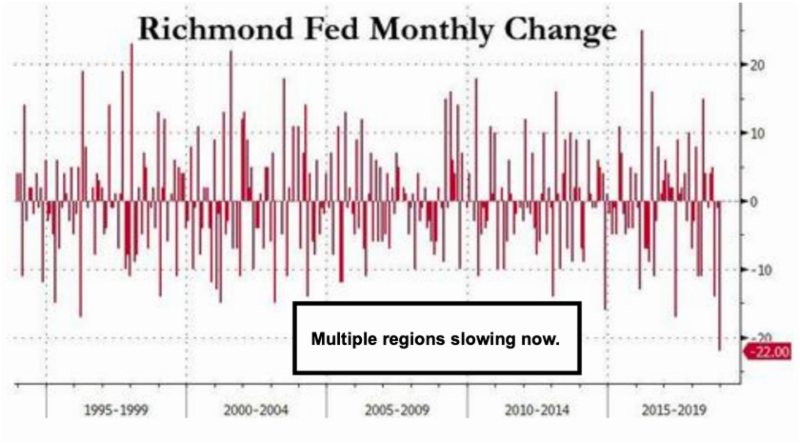

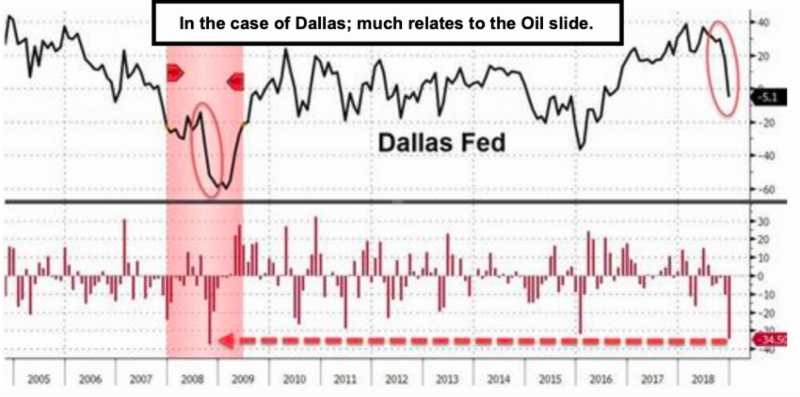

In-sum: this is basically what I’ve talked about for months as far as why we have a Fed hell-bent on snugging up and rationalizing monetary policy as if it were related to domestic economics in this situation. I thought it global in nature. The ECB is coming down a similar path. China too has enormous debt issues. And that indeed the U.S. economy is sluggish to a degree that does not support higher rates, but the overall picture required.

In fact, this infinite vision deficit picture, might demand even higher yields on the long-end for some time, even if stocks under-perform and economic sluggishness (recession officially or not) prevails. Needless to say, if one is looking for a potentially bearish picture beyond obvious price corrections or trade issues, or the many variables, consider this.

**

A teetering stock market, if also combined with unavoidable higher rates, is a truly concerning proposition, is it not? This is the backdrop we’ve indirectly reflected upon through much of the 2018 Fed policy. I’ll take a few moments to more clearly try to explain how this could affect a sketchy market environment for 2019.

Sure, we’d get huge rebound rallies from a trade deal (or avoiding political chaos), which is also short-term in terms of market response.

While trade and regulatory relief remains, they will become more favorable for stocks once a deal is done. Tax cut benefits won’t have the impact of the past. And very notable to all this as well, buybacks will diminish with enduring higher long rates.

This becomes a competitive issue to equities should that prevail. So, it is a reason I suspect this topic needed to be simplified a bit.

**

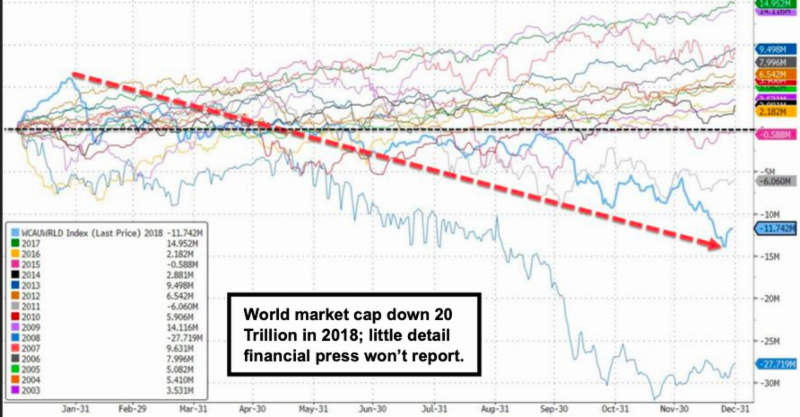

Bottom-line: 2018 was a challenging but rewarding bear market year. It’s one in which most only belatedly recognized it for what it was.

And in 2019 it will only reluctantly be acknowledged that it was the overly-easy for so long. The Fed (Bernanke) set up a problem to normalize policies. And what has become an unavoidable necessity to unwind the balance sheet given the new additions forthcoming.

**

It’s a shame of course the Fed couldn’t truly explain the extent of this challenge. We shall see if that is sufficiently offset by a potential China trade deal or not.

Remember, our bullishness for 2017 was predicated on tax relief (and so on) propelling the market even though the Fed was already removing the punch bowl at as gradual a pace as they could.

The market was already in shaky territory, which is why I thought it could buy time and shoot to the moon if Trump won and we got the fiscal set-up. Of course, that also trims the Treasury. So now the other side of the coin is the ballooning deficit. It is not really feasible to truly grow our way out of the situation with ease.